FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Metal Mining: 3Q24 preview: expect a slower quarter, but a majority beat in 9M24 due to low expectations (OVERWEIGHT)

- We estimate the sector’s 3Q24 earnings to fall back on lower ASP, though they may still beat estimates due to low expectations.

- We expect TINS to be the best performer in 3Q24 amid stable ASP with improvements in volume, while NCKL could be the strongest nickel play.

- We reiterate our Overweight rating on the sector with TINS and NCKL as top picks due to a stronger earnings visibility.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

Property News: The Housing Development Task Force to Recommend the Abolition of 11% VAT and 5% BPHTB (asset-transfer duties) to Upcoming Administration

- According to Head of Housing Development Task Force (Satgas Perumahan), Mr. Hashim Djojohadikusumo, the task force is receiving inputs to recommend abolition of 11% VAT and 5% BPHTB (asset-transfer duties) on property purchase. Mr. Hashim conveyed that the task force will try to convince the upcoming government to roll-out the program, with ultimate goal to alleviate poverty.

- The Head of Task Force is said to study the case of potential tax-revenue losses, involving experts including Bank Tabungan Negara Directors.

Comment:

- At present, the 11% VAT abolition has been implemented (until Dec24) and has proven to help spur demand in the sector, as reflected in the developers' marketing sales this year, with 25-60% of pre-sales contributed by VAT-eligible products.

- Meanwhile, we believe the abolition of BPHTB should remain under study, as the revenue collected is shared, with 80% allocated to regional governments and 20% to the central government (according to Permenkeu No. 03/PMK.07/2007).

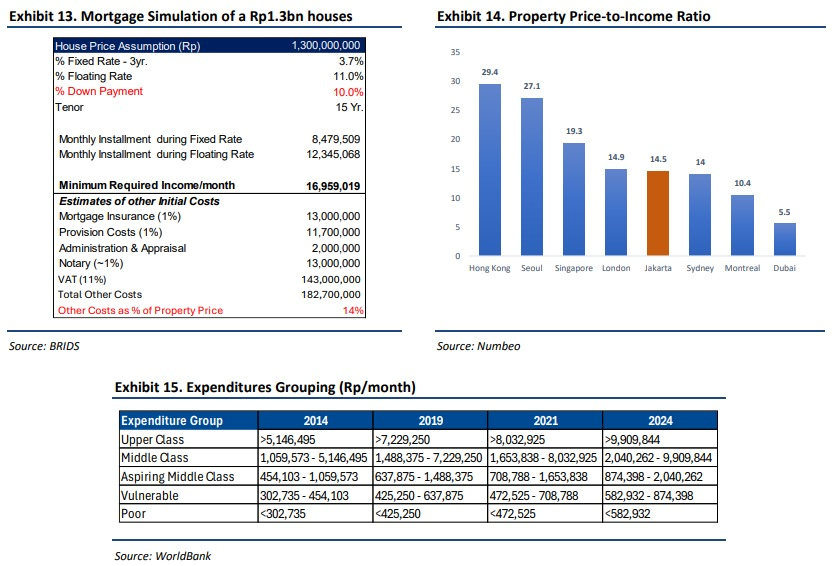

- Regardless, we maintain a positive view on the abolition of taxes related to property purchase. As we highlighted in our last sector report, affordability remains a key issue. Our simple simulation suggests that monthly installments fall within the expenditure bracket of the upper-middle class for obtaining residences within a reasonable distance to work and schools districts in Indonesia. Thus, lowering the burden of high initial investment costs will surely incentivize the demand-side

- Beyond the tax incentives, we believe that catering to the market demand of entry-level end-users (Rp1-2bn) with the Indonesian preference for landed residences, along with a comprehensive township infrastructure, will remain crucial factors in generating higher-than-expected marketing sales.

- Maintain OW rating with CTRA as our top picks.

- Our latest view on the sector (with key criterias to look for picking developers stocks): https://link.brights.id/brids/storage/34430/20240909-Property.pdf (Ismail Fakhri Suweleh – BRIDS)

SMRA (BUY, TP: Rp1,000) – 9M24 Marketing Sales Review

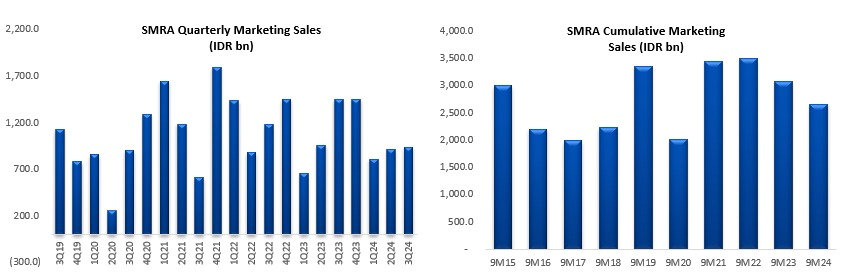

- SMRA booked marketing sales of Rp939bn in 3Q24 (+3%qoq, -35%yoy), bringing its cummulative 9M24 to Rp2.66tr (-13%yoy), with running rate to ours and company's FY24F target still came below expectations (to ours 58% and to company's target 53%).

- Tangerang Bitung project will determine the overall FY24F achievement, with our channel check indicate that the township has been on the stage of product knowledge currently. There will be also a new launching of houses-shophouses in Bogor and Bandung in 4Q24.

- Sep24 marketing sales of Rp307bn mainly contributed by Bandung project (29% contribution), which we believe should came from the launching of Cluster Hillary in Aug24.

- VAT marketing sales booked at Rp105bn in Sep24, bringing 9M24 achievement at Rp1.4tr (54% to total marketing sales, in-line with our estimates); which we expect to contribute to FY24F net profit ranging Rp400-500bn (50% to ours FY24F).

Company maintained its FY24F marketing sales target at Rp5.0tr. (Ismail Fakhri Suweleh – BRIDS)

|

Metal Mining: 3Q24 preview: expect a slower quarter, but a majority beat in 9M24 due to low expectations (OVERWEIGHT)

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY Property News: The Housing Development Task Force to Recommend the Abolition of 11% VAT and 5% BPHTB (asset-transfer duties) to Upcoming Administration · According to Head of Housing Development Task Force (Satgas Perumahan), Mr. Hashim Djojohadikusumo, the task force is receiving inputs to recommend abolition of 11% VAT and 5% BPHTB (asset-transfer duties) on property purchase. Mr. Hashim conveyed that the task force will try to convince the upcoming government to roll-out the program, with ultimate goal to alleviate poverty. · The Head of Task Force is said to study the case of potential tax-revenue losses, involving experts including Bank Tabungan Negara Directors. Comment: · At present, the 11% VAT abolition has been implemented (until Dec24) and has proven to help spur demand in the sector, as reflected in the developers' marketing sales this year, with 25-60% of pre-sales contributed by VAT-eligible products. · Meanwhile, we believe the abolition of BPHTB should remain under study, as the revenue collected is shared, with 80% allocated to regional governments and 20% to the central government (according to Permenkeu No. 03/PMK.07/2007). · Regardless, we maintain a positive view on the abolition of taxes related to property purchase. As we highlighted in our last sector report, affordability remains a key issue. Our simple simulation suggests that monthly installments fall within the expenditure bracket of the upper-middle class for obtaining residences within a reasonable distance to work and schools districts in Indonesia. Thus, lowering the burden of high initial investment costs will surely incentivize the demand-side · Beyond the tax incentives, we believe that catering to the market demand of entry-level end-users (Rp1-2bn) with the Indonesian preference for landed residences, along with a comprehensive township infrastructure, will remain crucial factors in generating higher-than-expected marketing sales. · Maintain OW rating with CTRA as our top picks. · Our latest view on the sector (with key criterias to look for picking developers stocks): https://link.brights.id/brids/storage/34430/20240909-Property.pdf (Ismail Fakhri Suweleh – BRIDS)

SMRA (BUY, TP: Rp1,000) – 9M24 Marketing Sales Review · SMRA booked marketing sales of Rp939bn in 3Q24 (+3%qoq, -35%yoy), bringing its cummulative 9M24 to Rp2.66tr (-13%yoy), with running rate to ours and company's FY24F target still came below expectations (to ours 58% and to company's target 53%). · Tangerang Bitung project will determine the overall FY24F achievement, with our channel check indicate that the township has been on the stage of product knowledge currently. There will be also a new launching of houses-shophouses in Bogor and Bandung in 4Q24. · Sep24 marketing sales of Rp307bn mainly contributed by Bandung project (29% contribution), which we believe should came from the launching of Cluster Hillary in Aug24. · VAT marketing sales booked at Rp105bn in Sep24, bringing 9M24 achievement at Rp1.4tr (54% to total marketing sales, in-line with our estimates); which we expect to contribute to FY24F net profit ranging Rp400-500bn (50% to ours FY24F). · Company maintained its FY24F marketing sales target at Rp5.0tr. (Ismail Fakhri Suweleh – BRIDS)

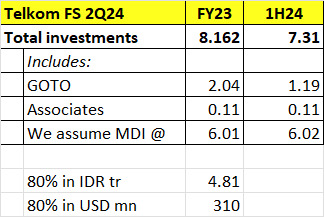

TLKM IJ (BUY, TP: Rp4,250) to monetize its MDI Ventures portfolio? · The news: MDI Ventures (Telkom 100% owned) has been suggested to sell 80%+ of its start-up portfolio to Saudi VC. · We roughly estimate that 80% of MDI book value is~ Rp4.8tr/ USD310mn. · MDI Ventures' VP said they are looking to monetize its aging investments (Dealstreet), including Kredivo, koinworks, Cermati, Paxel etc. · We add that Telkom possibly sees limited upside for further meaningful value creation. Total injections in MDI could be as much USD800mn through the years. (Niko Margaronis – BRIDS)

MARKET NEWS |

|

|

||||||||||||||||||||

MACROECONOMY

China’s CPI Rose 0.4% Yoy in Sep24

China's CPI rose 0.4% yoy in Sep24, softer than the consensus of 0.6%, with core inflation dropping to 0.1% yoy, the lowest since Feb-21. The PPI has declined annually for 24 consecutive months. (Bloomberg)

China's Ministry of Finance Unveils Comprehensive Stimulus

China's MoF announce a string of stimulus such as issuing bond issuance to help local gov't finance the off-balance sheet debt and replenish core tier-1 capita in major state banks, and also allowing local gov't to use special bond receipt to absorb unsold existing home. The MoF emphasized that the central gov't has significant room to increase the fiscal deficit. China's major banks have announced a rate cut for existing mortgages as of Oct 25, with a reduction of no less than 30bps below the current Loan Prime Rate. (Bloomberg)

SECTOR

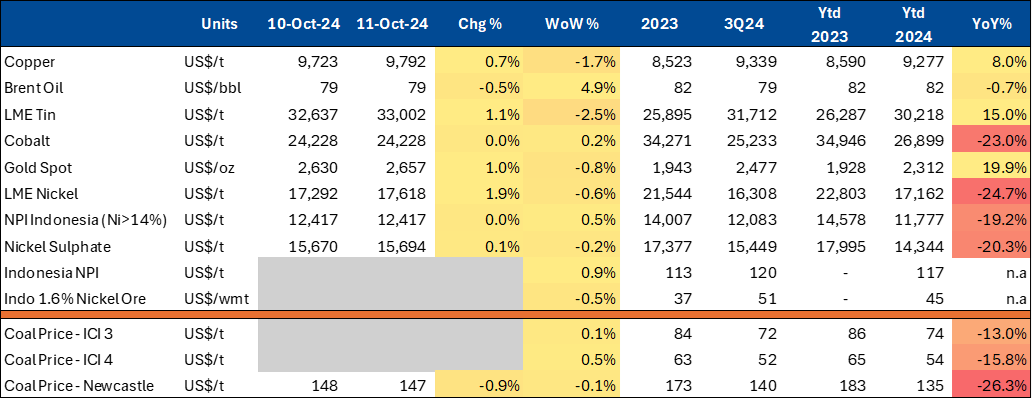

Commodity Price Daily Update Oct 11, 2024

Source: Bloomberg, SMM, BRIDS

Coal Production Rose to 624mn Tons in 9M24

National coal production for 9M24 increased by 0.7% to 624.16mn tons compared to 619.57mn tons in 9M23. This production level for 9M24 is equivalent to 87% of the national production target outlined in the 2024 Work Plan and Budget, which is set at 922.14mn tons. The 2024 production target comes from 587 mining business license holders. Meanwhile, coal production targets for 2025 and 2026 have been set lower, at 917.16mn tons and 902.97mn tons, respectively. (Kontan)

National Motorcycle Sales Grew 3.19% yoy as of Sep24

Indonesia's two-wheeler market has shown positive sales performance throughout 2024. According to data from the Indonesian Motorcycle Industry Association (AISI), national motorcycle sales reached 4,872,496 units in 9M24, reflecting a 3.19% yoy increase from 4,721,683 units during the same period last year. AISI has slightly adjusted its year-end sales projection to a range of 6.35mn to 6.45mn units, up from the previous estimate of 6.2mn to 6.5mn units. (Kontan)

CORPORATE

ASII Acquired Cardiac Hospital Heartology

Astra signed a deal to buy Heartology Cardiovascular Hospital, one of the private hospitals in Jakarta specializing in cardiology, for Rp643bn. No further disclosures yet on this transaction.

About Heartology Cardiovascular Hospital:

The initial team of doctors was established in 2020, consisting of a team of 8 doctors specializing in cardiology treatment. The hospital building itself was completed in 2023 and is located in Kebayoran Baru. Heartology has handled more than 1,500 heart cases, including 1,000 intervention cases and 400 heart arrhythmia cases. (Dealstreetasia)

Due Diligence for the EXCL and FREN Merger is Targeted to be Completed by the End of 2024

The due diligence process for the planned merger of EXCL and FREN is reported to be nearing completion. According to FREN, this aligns with the established merger schedule, where FREN's management aims to complete the due diligence phase by the end of 2024. (Kontan)

JPFA to Distribute Interim Dividend of Rp813.9bn

JPFA has announced the distribution of an interim cash dividend for FY24, amounting to a total of Rp813.93bn. Shareholders will receive Rp70/share (yield: 4.7%), with the dividend payment scheduled for October 29, 2024. This interim dividend distribution is in accordance with the decision made by the company’s board of directors, which was approved by the board of commissioners on October 9, 2024. (Emiten News)

INCO's Subsidiary, Sumbawa Timur Mining, to Develop New Copper Mine In NTB

INCO’s subsidiary, PT Sumbawa Timur Mining (STM), is working on a mining exploration project in Hu'u District, NTB. The total resource is estimated at 2.1bn tonnes, each tonne containing 0.86% copper and 0.48 g of gold. The company said it is currently in the process of completing the Pre-Feasibility Study and is targeted to enter the Feasibility Study stage in 2025, with production operations expected to start after 2030. (Kontan)

ISAT and UiPath Establish Partnership to Train 100k Digital Talents in Indonesia

ISAT has established a strategic partnership with UiPath, a provider of automation and artificial intelligence (AI) solutions for the business-to-business segment, to equip 100k digital talents in Indonesia with automation skills (Enterprise Automation) by 2027. This initiative aims to prepare digital talents to support Indonesia’s transformation into a global hub for AI and automation talent. (Investor Daily)

TOWR Lowers Rights Issue Target to Rp4.5tr

TOWR plans to conduct a Capital Increase with Pre-emptive Rights (PMHMETD) or Rights Issue by issuing 5bn new shares at an offering price of Rp900/share. TOWR aims to raise Rp4.5tr, this amount has been reduced from TOWR's previous plan to raise Rp9tr through the rights issue. The execution of the rights issue will take place after obtaining approval from the company’s extraordinary general meeting of shareholders (EGMS) on Oct. 25, 2024. (Emiten News)