FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Adaro Energy: Potential upside from AADI post spin-off; lowered rating to Hold with a higher TP of Rp4,100 (ADRO.IJ Rp 3,920; HOLD TP Rp 4,100)

- We estimate base-case valuation of AADI’s equity at US$6.1bn and ADRO’s valuation (post- AADI spin-off) at US$5.3-7.0bn.

- Key risk is downside if the market assigns a bigger Holdco disc.; this may be minimized with more visibility on renewable projects.

- We raised our TP to Rp4,100 but lowered our rating to Hold, based on our latest valuation of ADRO and AADI.

To see the full version of this report, please click here

GOTO Gojek Tokopedia: Confirming growth trajectories in 9M24; Further monetization through tech advancements (GOTO.IJ Rp 64; BUY TP Rp 90)

- 9M24 adjusted EBITDA loss was reduced to Rp-13bn, supported by GTV growth, with 3Q24 at Rp137bn, on track toward FY24 profitability.

- We anticipate further CM growth for ODS and GTF, driven by ODS GTV and loans with EBITDA margin expansion on cloud optimizations and AI.

- We maintain Buy rating with a DCF-based TP of Rp90, assuming a 6% CAGR for FY24-34 GTV.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

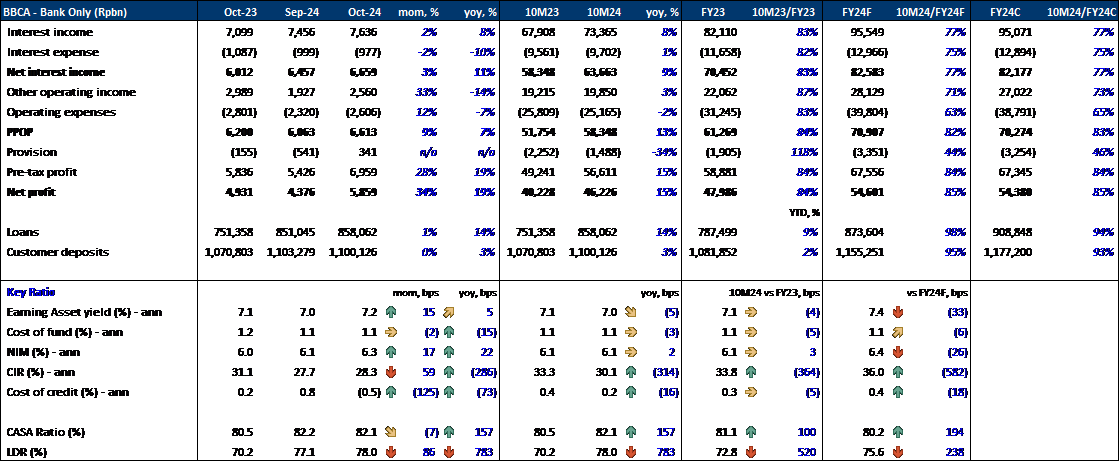

BBCA (Buy, TP:Rp12,800) - Oct24 Results

10M24 Insight:

- Net profit grew 14%: BBCA posted a net profit of Rp46.0tr in 10M24, growing 15% yoy, achieving 85% of our and consensus’ FY24 estimate, in line.

- NII and PPOP growth remained robust: The bank recorded positive growth in NII (+9%) and PPOP (+13%), driven by a resilient NIM and lower CoC.

- Resilient NIM amid tight liquidity: NIM held steady at 6.1% (flat yoy), with higher LDR offsetting a slightly lower EA yield. LDR stood at 78% in 10M24 (+783bps yoy) as loan growth grew 14%, while deposit growth was only 3% yoy.

- Improving CIR: CIR improved to 30.1% (-314bps yoy) as opex remained efficient with -2% yoy growth, while NII grew by 9%.

- Low CoC: Asset quality stayed strong, with a low CoC at 0.2% (vs 0.4% in 10M23).

Oct24 Insight:

- Strong net profit in Oct24: In Oct24, BBCA’s net profit reached Rp5.9tr (+34% mom, +19% yoy), supported by PPOP (+9% mom, +7% yoy) and provision reversal.

- Higher PPOP driven by higher NIM: NIM increased to 6.3% in Oct24 (+17bps mom, +22bps yoy) due to a combination of higher EA yield, lower CoF, and higher LDR.

- Higher EA yield and lower CoF: EA yield improved to 7.2% in Oct24 (+15bps mom, +5bps yoy), while CoF stood at 1.1% (-2bps mom, -15bps yoy), signaling the bank's ability to lower its TD amid a lower benchmark rate. CASA ratio remained relatively steady mom at 82%.

- Provision reversal in Oct24: CoC turned negative in Oct24 at -0.5% (Sep24/Oct23: 0.8%/0.2%), indicating the bank’s confidence in asset quality.

Summary:

- Overall Performance: We view the Oct24 results as a strong performance, with higher NIM driven by improved CoF (amid still tight liquidity) and higher EA yield (amid tight loan competition). The high net profit growth in Oct24 was also driven by CoC, which indicates robust asset quality. (Victor Stefano & Naura Reyhan Muchlis - BRIDS)

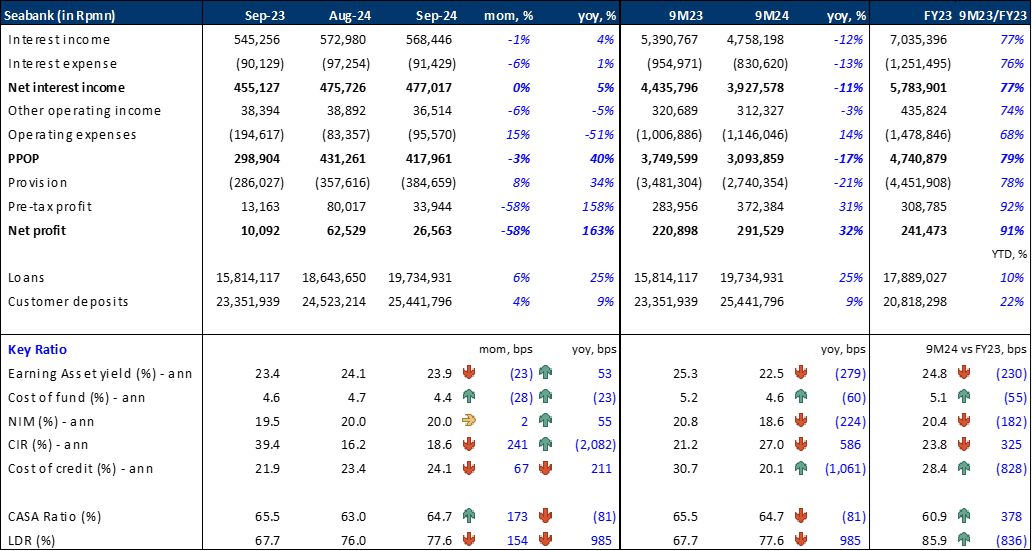

Seabank Sep24 Results

9M24 Insight:

- Decline in Provisions Drove Net Profit Growth: Seabank’s net profits reached Rp292bn (+32% yoy) in 9M24, supported by a 21% decline in provisions, despite a 17% yoy drop in PPOP.

- Rise in CIR: CIR increased to 27.0% in 9M24 from 21.2% in 9M23, due to an 11% yoy decline in NII and a 14% yoy rise in opex, driven by increases of 17.8%, 15.1%, and 12.1% yoy in promotion, salaries, and other expenses, respectively.

- NIM Drop Despite Higher LDR: NIM decreased by 224bps yoy to 18.6% in 9M24, despite a higher LDR and a 60bps drop in CoF to 4.6%, due to a 279bps yoy decline in EA yield to 22.5%.

- Loans and Customer Deposits: Loan growth (+25% yoy) outpaced customer deposit growth (+9% yoy) in 9M24, leading to a higher LDR of 77.6% (+154bps mom, +985bps yoy).

- Substantial CoC Improvement: CoC improved to 20.1% in 9M24, compared to 30.7% in 9M23.

Sep24 Insight:

- Net Profits: Seabank recorded net profits of Rp27bn in Sep24, down 58% mom from the high base last month but up 163% yoy. The strong yoy growth was driven by a 51% drop in opex, as Sep23’s promotional expense was Rp83bn, whereas Sep24’s stood at Rp8.2bn.

- One of The Lowest CIR among Digital Banks: Seabank’s CIR remained one of the lowest among digital banks at 18.6% (+241bps mom, -2,082bps yoy) in Sep24.

- Stable NIM Driven by CoF Improvement: NIM was stable at 20.0% (+2bps mom, +55bps yoy) in Sep24, supported by an improved CoF of 4.4% (-28bps mom, -23bps yoy) and an EA yield of 23.9% (-23bps mom, +53bps yoy).

- CoC: CoC rose to 24.1% (+67bps mom, +211bps yoy) in Sep24.

- Loans and Customer Deposits: Loans and customer deposits grew by 6% and 4% mom, respectively. The CASA ratio stood at 64.7% (+173bps mom, -81bps yoy) in Sep24.

Summary:

- Overall Performance: Seabank demonstrated solid performance in Sep24, with robust yoy net profit growth. Furthermore, the bank maintained one of the lowest CIRs among digital banks, reflecting its efficiency, with stable NIM supported by improved CoF. (Victor Stefano & Naura Reyhan Muchlis - BRIDS)

MARKET NEWS

MACROECONOMY

China's Consumer Showed Improvement in Oct24 as Retail Sales and Industrial Output Rise

China's consumer showed improvement in Oct24 with 4.8% yoy growth in retail sales, higher than 3.2% in Sep24, following a string of stimuli rolled out by the government. Industrial output remained strong with 5.3% yoy growth. (Trading Economics)

Indonesia's trade surplus stood at US$2.47bn in Oct24

Indonesia's trade surplus stood at US$2.47bn in Oct24, down from US$3.26bn in September due to an expanding oil & gas deficit. Exports grew by 10.25% yoy (10.69% mom) to US$24.41bn in Oct24, largely due to a spike in palm oil exports. Crude palm oil (CPO) and its derivatives rose by 70.9% mom and 25.3% yoy, with export volume up by 57% m-m and palm oil prices up by 23.6% yoy. Imports surged 17.49% yoy to US$21.94bn in Oct24, the highest value since Aug22. All import categories showed annual growth: consumer goods rose by 12.2%, raw/auxiliary materials by 18.5%, and capital goods by 16.4%. (BPS)

SECTOR

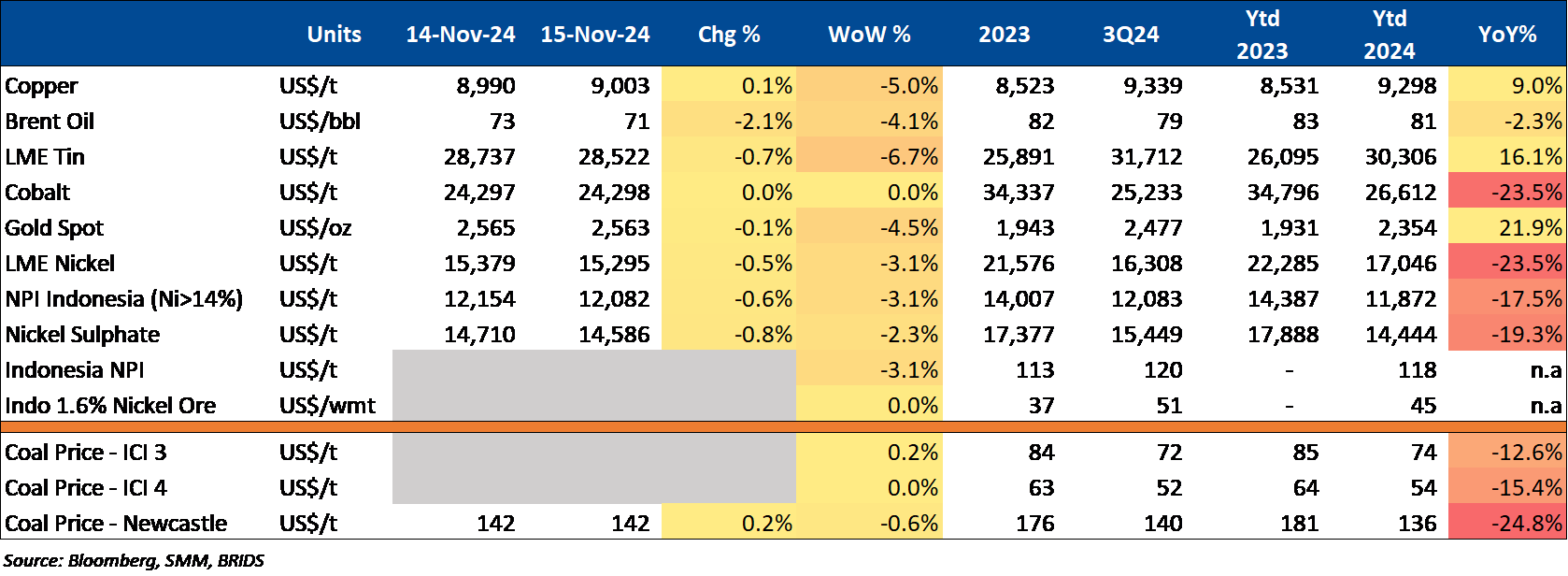

Commodity Price Daily Update Nov 15, 2024

Indonesia Seeks Rp9,542tr Investment for Downstreaming 26 Commodities

The Indonesian President has invited Pacific-region businesses to invest in Indonesia’s downstreaming of 26 commodities, a project requiring an estimated US$600bn or Rp9,542tr. The govt. emphasized Indonesia's vast potential in sectors like fisheries and processing industries, noting the essential role of business in economic growth, job creation, and poverty reduction. (Kontan)

Minister of Housing and Settlement (PKP) Proposes Rp48.5tr Budget Increase for 3mn Homes Program

The Minister of Housing and Settlement (PKP) has proposed an additional Rp48.5tr for the 3mn Homes Program, highlighting a budget gap, as the current allocation for the program is only Rp5.1tr. The Housing Task Force estimates a total need of Rp53.6tr. The minister also plans to increase subsidized homes from 220k to 800k units and adjust mortgage funding ratios to improve access to affordable housing. (Kontan)

CORPORATE

DSSA Sold FREN Shares and Extended Loan Facility to Bali Media Telekomunikasi

DSSA sold Rp562.15bn worth of FREN shares to PT Bali Media Telekomunikasi (BMT), involving 22.49bn shares at Rp25/share. DSSA also provided a loan facility amounting to US$525mn or Rp8.3tr to BMT. (Investor Daily)

FREN Secures Rp10tr Syndicated Loan from BBCA and Partners

FREN has secured an Rp10tr syndicated loan from BBCA and other banks, including PT Sarana Multi Infrastruktur (SMI) and PT Bank Digital BCA. The loan, signed on November 14, 2024, will be used for refinancing, spectrum auction funding, and capital expenditures. It offers a more competitive interest rate than existing loans, with a seven-year term. (IDX)

MPMX Boosts Used Car Sales

MPMX, through its subsidiary Auksi, is optimistic about growth in the used car market as new car sales decline. Rising new car prices are driving consumers to seek more affordable options. In response, MPMX is expanding its consignment services, allowing individuals and companies to offer quality used cars at competitive prices. This strategy aims to meet the increasing demand for economical transportation solutions. (Kontan)