FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Banks: 4M24 Banks-Only Results: Pressure on CoF not yet out of the woods, but asset quality remains safe (OVERWEIGHT)

- Supported by lower CoF increases compared to their peers, only BBCA, BRIS, and NISP booked double digit NP growth in 4M24.

- Despite a slight improvement (-4bps mom) in Apr24, COF pressure might return in May24 from a higher benchmark rate.

- For its resilient CoF, higher liquidity, and better NP growth outlook compared to its peers, BBCA remains our top pick in the sector.

To see the full version of this report, please click here

Telkom Indonesia: KTA from meeting with TSEL CFO: reaffirmed defensive mode with profitability as top priority (TLKM.IJ Rp 3,050; BUY; TP Rp 4,400)

- TSEL’s CFO reiterated its defensive stance amid peers’ expansions by positioning in new segments and empowering sales.

- TSEL launches ‘EZnet’ product under Indihome at lower price points to tap new markets and maintain ~70% market share amid shift to FMC.

- Maintain BUY rating on TLKM and TP of Rp4,400, as we see TSEL’s FMC grand plan to be taking shape in 2H24

To see the full version of this report, please click here

To see the full version of this snapshot, please click here

RESEARCH COMMENTARY

Blibli (BELI IJ) – Announcing MESOP and Non – preemptive RI concurrently.

Blibli seeks to raise Rp2.3tr via non-preemptive rights issue offering 3.7-3.8% stake in the company with the offering to be valid for 2 years at Rp478/per new share. In parallel the BOD will be asking approval in the EGMS (to be held on the 13th of June) there will be a MESOP program to seek approval, about 3.65% of existing shares.

Comment:

We can number 4 strong key selling points in Blibli to offer to potential investors:

- good execution of the 1P retail model in Indonesia,

- omnichannel strategy with 63 supermarkets, 172 for electronics stores or a total 235 offline points of presence.

- a strong OTA engine with Tiket.com (Traveloka currently consolidating its market position),

- and the built of modern warehouse of 100,000sqm to be available from 4Q24.

We understand that foreign ecommerce players may seek partnership with a local player to enter the Indonesian market and whose model relies on a strong value chain, hence warehouse capacity is essential,

SMRA (BUY, TP: Rp1,000) – 5M24 Marketing Sales Review

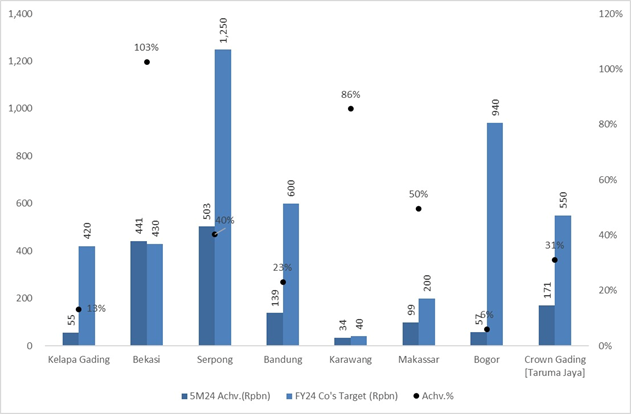

- SMRA booked marketing sales of Rp1.49tr during 5M24, booking double-digit growth of +12%yoy, yet still below expectations (27% of our FY24F and 30% of the company's target). We are currently reviewing our FY24 marketing sales forecast.

- Several key projects showed relatively good traction, however, with Bekasi already reaching 103% of the FY24F target, Serpong 40%, Karawang 86%, and Makassar 50%. Meanwhile, Bandung (23% of the FY24F target), Bogor (6%), and Crown Gading (31%) were below expectations.

- Mortgages were the most popular terms for payment in 5M24 at 57% vs. 38% in 5M23. By product type, houses remained dominant at 82% of total 5M24 pre-sales compared to 51% in 5M23. We believe this is a reflection of the property macro theme in FY24, with sales of landed residential property the driver of growth, supported by VAT and LTV incentives.

- Commercial projects’ contribution was smaller due to the high-base of Rp444bn pre-sales of shoplots in 5M23, mainly contributed by the launching of Downtown Drive Summarecon Serpong (pre-sales recorded at ~Rp300bn, price/unit starting from Rp3.1bn with 136sqm building size). As there were no launches of shoplots YTD, SMRA only booked Rp54bn of pre-sales during 5M24.

- SMRA remains one of the cheapest options in the property sector, with a current price discount to RNAV of 84% vs. its peers’ average of ~69%. (Ismail Fakhri Suweleh – BRIDS)

MARKET NEWS

MACROECONOMY

US Non-Farm Payrolls Increased by 272k in May24

US Non-Farm Payrolls increased by 272k in May24, exceeding market expectation of a below 200k increase. Average Hourly Earnings growth ticked up to 4.1% yoy from Apr’s 3.9%. From the household survey, the unemployment rate rose to 4% from 3.9%, inline with the Fed’s estimates in March’s economic projection. The 10-year UST yield climbed by more than 10bps with the DXY nearing 105. (Bloomberg)

Indonesia’s FX Reserves Surged to US$139bn in May24

May’s FX reserves surged to US$139bn, up from April's US$136.2bn. This increase is attributed to tax revenue and the issuance of government global bonds. The May reserves figures suggest a small probability of market intervention by BI, although the issuance of US$1.2bn of samurai bonds may have contributed to the FX reserves increase. (Bank Indonesia)

SECTOR

Government Establishes Maximum Retail Price (HET) for Rice

The National Food Agency (NFA) has issued a new regulation on the Highest Retail Price (HET) for rice, implementing the previous relaxation. The regulation varies by region, with medium quality rice prices in Java, Lampung, and South Sumatra set at Rp12,500/kg and premium rice set at Rp14,900/kg. Other regions have medium quality rice prices set at Rp13,100/kg and premium rice prices set at Rp15,400/kg. The regulation also applies to the Bali and NTB regions, NTT, Sulawesi, Kalimantan, Maluku, and Papua. (Kontan)

CORPORATE

ACES to Disburse Dividends of Rp572bn

ACES has approved the distribution of Rp572bn in dividends for FY23 profits, with the amount being Rp33.5/share (div. yield: 4%), equivalent to 75% of the 2023 net profit. (Emiten News)

HRUM Prepares Capex of US$687mn

HRUM has prepared a US$687mn investment and capital expenditure budget for this year, equivalent to Rp11.1tr. Around 95% will be used for the existing nickel business segment, while the rest will support the coal business. HRUM spent capex of US$17.4mn in 1Q24, mainly on mining properties and vehicle purchases. The company will focus on expanding its assets portfolio, particularly expanding nickel capacity for downstream processes, to diversify derivative nickel products. (Kontan)

MBMA Intends to Issue 10.79bn New Shares via a Rights Issue

MBMA intends to issue 10.79bn new shares via a rights issue, a 10% increase from the total number of fully paid-up shares. The new shares, valued at Rp100, aim to strengthen the company's capital structure and provide additional funds for performance. If shareholders do not exercise their pre-emptive rights, their ownership could be subject to a maximum 9.1% dilution. The net funds from the rights issue will cover liquidity needs, capital expenditure, and business development. (Emiten News)