FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Retail: FY25 Outlook: Expansion-Driven Strategy to Sustain Double-Digit Earnings Growth

- Despite challenges from a weak currency and rising wages, we expect retailers to continue their store expansion plans in FY25.

- We estimate the sector’s FY25 rev. growth of 15% yoy, driven primarily by store expansions, which should support NP growth of 16.8% yoy.

- Maintain Overweight stance on the sector’s FY25 double-digit growth. Our top picks are MAPI, followed by MIDI.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS

MACROECONOMY

China to Boost 2025 Investment with Ultra-Long Treasury Bonds

China will sharply increase funding from ultra-long treasury bonds in 2025 to spur business investment and consumer-boosting initiatives. Special treasury bonds will be used to fund large-scale equipment upgrades and consumer goods trade-ins. (Reuters)

SECTOR

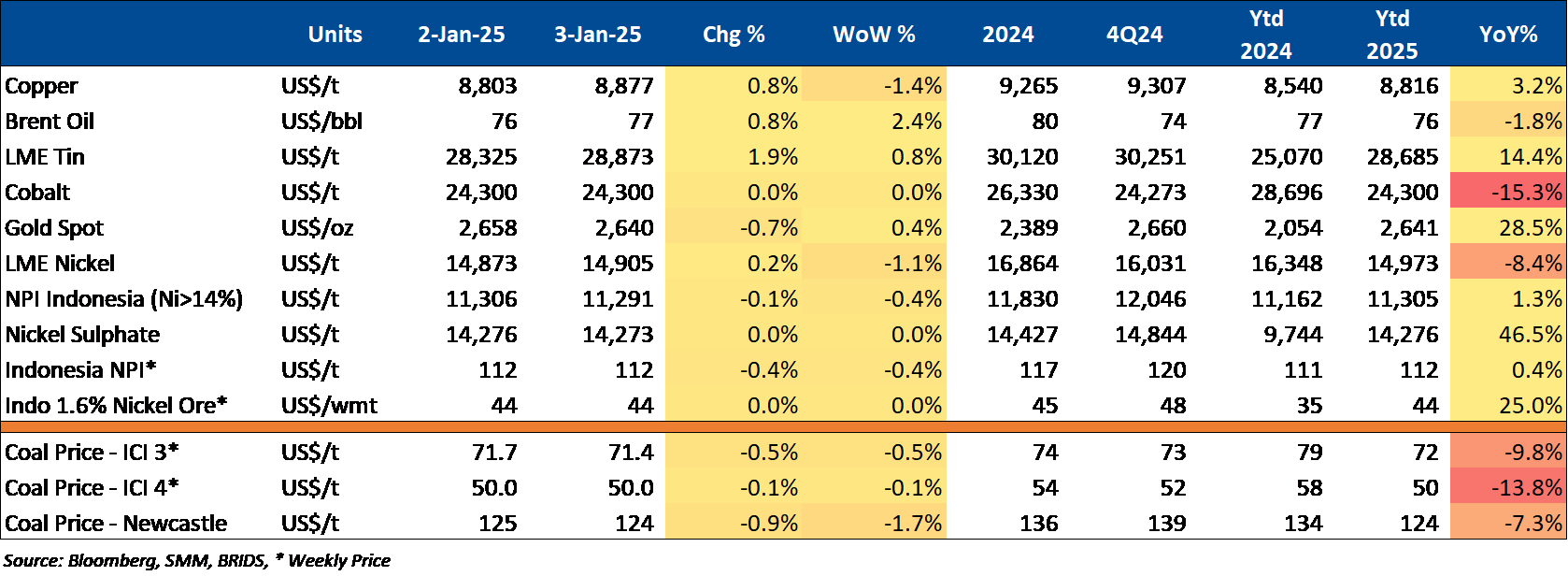

Commodity Price Daily Update Jan 3, 2025

Impact of Cigarette Price and Tax Increases on the Tobacco Industry

The Indonesian Tobacco Industry Association (GAPPRI) is concerned that the government's decision to raise cigarette prices by 10.5% and increase VAT to 10.7% in Jan25 will encourage the spread of illegal cigarettes. GAPPRI estimates that cigarette prices could rise by up to 28.27%, particularly affecting hand-rolled kretek cigarettes. The association warns that these price hikes, coupled with higher taxes, will heavily burden the tobacco industry and may not improve consumer purchasing power despite higher minimum wages. (Investor Daily)

CORPORATE

AADI Targets 65.5mn Tons of Coal Production in 2025

AADI targets coal production to reach 65.5mn tons in 2025. This figure is nearly the same as the 2024 target for thermal coal production, set at 61mn to 62mn tons. (Bisnis)

BBTN Acquires Properties for Branch Relocations

BBTN spent Rp15.89bn to acquire properties in Tegal and Pangkalpinang from Asuransi Jiwa IFG for branch relocations. The transactions, completed on 31st Dec24, are affiliated, as IFG is government-controlled. The relocations aim to expand office capacity and improve customer service. (Emiten News)

ISAT Nataru 2024/2025: 10% Traffic Increase, Customer Complaints Reduced by 36%

ISAT recorded a 10% increase in data traffic during the 2024/2025 Christmas and New Year (Nataru) period. The use of artificial intelligence (AI) successfully reduced customer complaints by 36% compared to regular days. ISAT optimized approximately 190,000 4G base transceiver stations (BTS), 103 5G BTS, and AI technology to ensure customer satisfaction during this period. (Bisnis)

PGEO Allocates US$300mn Capex for Strategic Projects in 2025

PGEO has set aside US$300mn in capital expenditure for 2025 to support development programs and strategic projects, including boosting its capacity to 1 GW. Key progress has been achieved in the Lumut Balai Unit 2 EPCC project, with major equipment now on-site, alongside accelerated steam-blowing processes to ensure steam availability. (Bisnis)

UNTR Injects Rp176.17bn into BPE

UNTR, through its subsidiary, Energia Prima Nusantara (EPN), injected Rp176.17bn into Bina Pertiwi Energi (BPE) on 31st Dec24, boosting EPN's stake to 391,499 shares. The affiliated transaction supports BPE's working capital, with shared ownership and overlapping management between UNTR, EPN, and BPE. (Emiten News)

WINS to Add Fleet in 2025

WINS sees a positive business outlook in 2025, supported by the planned addition of new fleet units that are expected to be operational this year. With this expansion, WINS targets an increase in utilization to 75% (2024: 68%). Additionally, WINS aims for a 10-15% increase in vessel charter rates, driven by the limited number of new ships available for operation. Meanwhile, the 2025 capex budget is still being prepared and has not yet been disclosed. (Kontan)