|

FROM EQUITY RESEARCH DESK |

|

||||||||||

|

IDEA OF THE DAY |

|

||||||||||

|

Jasa Marga: Reinitiate with Buy rating; Attractive FY24-25 28%-33% EPS growth from deleveraging and tariff hikes (JSMR.IJ Rp 5,475; BUY TP Rp6,500) · We forecast FY24-25F revenue to grow by 11%-24%, driven by new toll roads’ traffic acceleration and impact of special tariff hike (18%-35%). · We expect JTT divestment proceeds to be used for deleveraging, while capex will also be moderating at Rp6tr-7.3tr (vs Rp23tr-46tr in FY17-23). · We estimate attractive 28%-33% core EPS growth with upsides from lower rates, thus, we reinitiate with a BUY rating and a TP of Rp 6,500. To see the full version of this report, please click here

To see the full version of this snapshot, please click here

|

|

|

|

|

|

|

|||||

|

RESEARCH COMMENTARY Auto Data Jul24 · Jul24 4W wholesales reached 74k units in Jul24 (+2%mom/-8% yoy), bringing 7M24 sales to 482k units (-18% yoy), relatively in line with seasonality. · Among the top 10 selling brands in Jul24, only Mitsubishi (+1% yoy), Hyundai (+3% yoy), and Hino (+23% yoy) recorded growth, while Toyota/Daihatsu/Honda sales declined by 10%/12%/41% yoy. · 4W retail sales reached 75k in Jul24 (+8% mom/-1% yoy). Based on wholesale and retail sales differences, we find no indication of overstocking in dealer level.

Comment: we expect slight normalization of ASII’s market share in Jul24, from ~60% in Jun24 and Jul23, given lower Toyota and Daihatsu sales. As the trend on top 10 selling brands, we expect more Chinese players (ie BYD, Chery) contribution to Jul24 sales. We expect competition to heat up, especially on EV and the Rp350-400mn segment. However, we think mom retail sales growth was rather weak in Jul24, given the GIIAS event that occurred in that month. Previously, the month with GIIAS event could record >10% mom sales growth (vs 8% in Jul24). (Richard Jerry, CFA & Christian Sitorus – BRIDS)

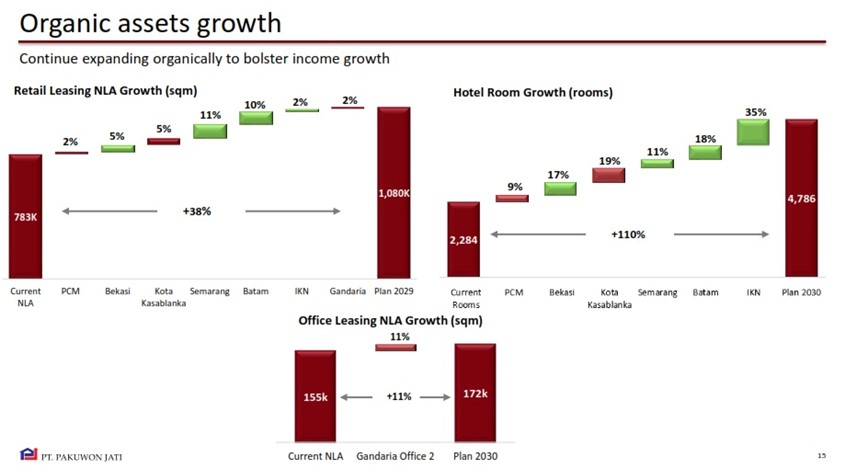

KTA Call with PWON: Stable Recurring Revenue Business

We have a Buy rating on PWON with our last TP of Rp610.

Attachment: NLA Expansion Pipeline. Link to our last KTA meeting with JLL note: https://tinyurl.com/KTA-JLL (Ismail Fakhri Suweleh - BRIDS)

MARKET NEWS |

|

||||||||||

MACROECONOMY

China Inflation Reached 0.5% yoy in Jul24

China Inflation reached 0.5% yoy in July 2024. The highest reading in five months and exceeded estimates of 0.3%. Food price, which is the main deflationary pressure, was flat in July, a better reading considering it was preceded by 12-month deflation streak. Non-food and Core CPI continue to rise. (Trading Economics)

Indonesia Retail Sales in Jun24 got revised down to 2.7% from 4.4%

The Retail Sales Index reached 229.0, a 2.7% yoy/0.4% mom growth in Jun24. Sales growth was seen significant in Vehicle Spare part and Accessory with 11.4% rate, followed by Food, Beverages, & Tobacco with 3.5% rate. This increase was attributed to increased activity during Eid al-Adha HBKN and school holidays, as well as increased demand for the 2024/2025 new school year. In July, Retail Sales is estimated grew by 4.3% with FnB accelerated to 6.4% yoy. (Bank Indonesia)

SECTOR

The Minister of Trade Has Issued Regulation Number 16 Of 2024

The Minister of Trade has issued Regulation Number 16 of 2024, aimed at optimizing the implementation of trade safeguard measures. The regulation, promulgated on July 2, 2024, and effective on July 12, 2024, improves the previous Permendag 37/2008 concerning Certificate of Origin for Imported Goods Subject to Safeguard Measures. It requires importers from countries exempt from safeguard duty to include a non-preferential Certificate of Origin for importing goods subject to safeguard measures. (Emiten News)

CORPORATE

EXCL Traffic in IKN Increased by 300% Over the Past Year

EXCL reported a more than 300% increase in telecommunications traffic in the Ibu Kota Nusantara (IKN) area, East Kalimantan, over the past year. This traffic increase is driven by the growing number of construction workers and public visits. (Investor Daily)

HRUM Seeks Shareholder Approval for A Rp1tr Share Buyback

HRUM seeks shareholder approval for a Rp1tr share buyback to boost stock trading liquidity and reflect the company's fundamental condition. The plan will be submitted at the EGMS on September 17, 2024. (Emiten News)

ISAT: Announced Stock Split Plan with a 1:4 Ratio; Partners with Google Cloud

ISAT plans to conduct a stock split with a 1:4 ratio for all Series B shares. This stock split will reduce the nominal value of Series B shares from Rp100/share to Rp25/share. It will also increase the number of outstanding shares to 32.25bn (prev: 8.06bn). ISAT will seek shareholder approval at an Extraordinary General Meeting on September 24, 2024. (Bisnis)

In other news, ISAT and Google Cloud have partnered to provide Indonesian enterprises with next-generation cloud services, ensuring data storage, security, and privacy. The partnership aims to empower critical industries like defense, healthcare, financial services, energy, utilities, and manufacturing with AI and analytics capabilities, while protecting sensitive data. (Kontan)

NFCX Recorded Over 1mn Electric Motorbike Rental Transactions

NFCX, part of the MCASH Group, has maximized its electric motorbike rental business through the Semolis service. NFCX recorded over 1mn top-up transactions on the Volta electric motorbike rental app. Semolis offers Volta electric motorbikes through two rental options: (1) regular rental and (2) rent-to-own (RTO). With the RTO service, Semolis users can eventually own the Volta motorbike at the end of the contract. (Kontan)