FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

BRIDS FIRST TAKE

- XLSmart Telecom Sejahtera: 3Q25 Results: Mobile Recovery In-line With Industry; Merger-Related Cost Remain Fluctuate (EXCL.IJ Rp2,750; BUY TP Rp3,310)

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS

SECTOR

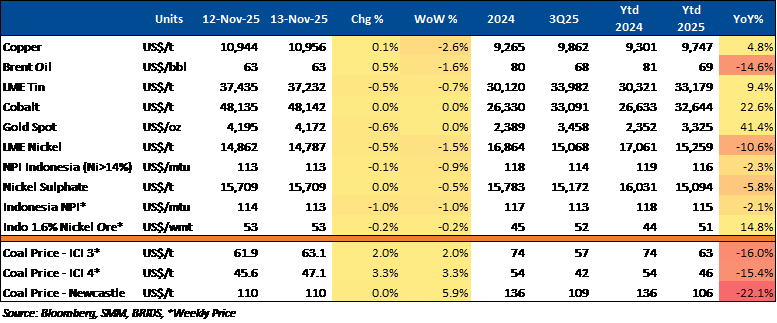

Commodity Price Daily Update Nov 13, 2025

CORPORATE

BBRI Strengthens Digital Growth with 44.4mn BRImo User

BBRI recorded 44.4mn BRImo users as of September 2025, up 19.4% yoy, with daily transaction value surging to Rp25tr from Rp14tr in March. The strong growth reflects higher digital transaction utilization across BRImo, Qlola merchant, EDC, QRIS, and AgenBRILink. This momentum lifted third-party funds (DPK) by 8.2% yoy. (Emiten News)

BUMI Expands into Bauxite and Gold Mining

BUMI signed a term sheet with PT Supreme Global Investment to acquire 45% of PT Laman Mining—a bauxite miner—for US$59.1mn (Rp988.9bn), paid in two stages through 2026. The company also completed the 100% acquisition of Australia’s Wolfram Limited for Rp698.98bn, marking its strategic diversification beyond coal into gold and bauxite mining. (Bisnis)

GoTo–Grab Merger Talks May Grant Danantara a Golden Share

GoTo and Grab are in merger talks and may offer Indonesia’s sovereign wealth fund, Danantara, a “golden share” to secure regulatory approval. The special share would give Danantara enhanced rights over the merged entity’s Indonesian operations, including influence on driver pay. (TechinAsia)

MEDC Sets Exchange Rate for Interim Dividends

MEDC set the exchange rate for its US$42mn interim dividend distribution, scheduled for November 28, 2025, based on Bank Indonesia’s middle rate as of November 12, 2025. The company will pay US$0.0017 per share, equivalent to Rp28.44 per share (yield: 2.2%), to both local and foreign shareholders. (Investor Daily)