FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Aspirasi Hidup Indonesia: Solid Jan25 Sales Driven by New Stores, but soft SSSG at 3.4% (ACES.IJ Rp 780; BUY TP Rp 1,100)

- ACES reported 1M25 sales growth of 9.5% yoy (FY25F: 11.9% yoy) with Jan25 SSSG of 3.4% (vs. our FY25F of 7.2%).

- AZKO stores continued to see strong foot traffic, especially on weekends, reinforcing the customer familiarity with the brand.

- We expect better sales and SSSG in the coming months leading up to the Eid Festive, Reiterate our Buy rating with TP of Rp1,100.

To see the full version of this report, please click here

Telkom Indonesia: Well-positioned as LT FMC Play; Defending market share and gearing up for FMC deployments (TLKM.IJ Rp 2,670; BUY TP Rp 3,680)

- TSEL navigated 4Q24 with stable mobile subs and higher ARPU, showing ability to defend market share with the help of second-tier brands.

- TSEL is gearing up for a major push with single billing features that will make users stickier ringfencing mobile/fixed traffic in its networks.

- We trimmed FY25-26 est. by -4.0%/-3.8% and arrive at lower TP of Rp3,680; maintain Buy rating on TLKM as the best LT play for FMC.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

BNGA (Not Rated) - 4Q24 Results and Concall KTA

FY24 Insights:

- Net Profit Increased Due to Lower Provision Expenses: BNGA reported a 5% yoy net profit increase to Rp6.8tr, driven by a 10% yoy decrease in provision expenses with flat PPOP. FY24 results are in line with consensus estimates (101%).

- Slight Decrease in NII due to Higher CoF: NIM declined by 29bps to 4.0%, as loan yield remained flat while CoF rose by 57bps to 4.1% due to tight liquidity amid 11% deposit growth.

- Strong Deposit Growth: Deposits grew 11% yoy, driven by a 25% increase in CA, most of which management attributed to transactional CA. LDR stood at 87.5% in FY24, lower than 90.5% in FY23, as loans only grew by 7%.

- 7% yoy Loan Growth Driven by Wholesale: The SME and corporate segments grew by 9% and 8%, respectively, while consumer loans rose by 5%. Lower consumer growth was driven by a 2% decline in mortgages, while the smaller auto and unsecured loan segments grew by 26% and 8%, respectively. Management aims to reverse the mortgage loan trend as they see opportunities to compete in second-tier cities.

- CoC Decreased as Asset Quality Remained Safe: The bank reported a CoC of 0.8% (-15bps yoy) in FY24, with a better NPL ratio of 1.8% (down from 2.0%) and an improved LaR ratio of 8.6% (from 11.2%). Management attributed these improvements to better quality across all segments.

- Lower ROE but Higher DPR Expected: ROE declined to 13.4% in FY24 from 13.8% in FY23, but management is considering a higher dividend payout ratio, increasing from 50% to 60%.

4Q24 Insights:

- Net Profit Decline qoq Due to Higher CoF: BNGA’s net profit declined to Rp1.7tr (-2% qoq, +8% yoy) due to tight funding competition in 4Q24.

- NIM Fell Below 4%: NIM fell to 3.8% in 4Q24 (from 4.0% in both 4Q23 and 3Q24). Management expects steady CoF in FY25F despite rate cut expectations, as they do not foresee funding improvements despite the recent 50bps BI rate cut.

- Lower Effective Tax Rate in 4Q24: The effective tax rate was reported at 18.1% in 4Q24 (compared to the usual 21-22% range). The bank also reported approximately Rp185bn in other non-operating income in 4Q24.

- Strong Loan Growth in 4Q24: Loans grew 4% qoq to Rp228tr (+7% yoy), driven by auto, SME, and corporate loans. To meet loan demand, the bank offered higher yields near the end of FY24 after losing some affluent SA clients to banks offering higher TD rates.

- Asset Quality Remained Sound: The NPL ratio improved to 1.8% (-25bps qoq, -19bps yoy), and the LaR ratio improved to 8.6% (-100bps qoq, -260bps yoy). NPL and LaR coverage remained high at 270% and 55%, respectively.

FY25 Guidance:

- 5-7% loan growth vs. FY24’s 6.9%.

- 9-4.2% NIM vs. FY24’s 4.1%.

- Below 1% CoC vs. FY24’s 0.8%.

- Below 45% CIR vs. FY24’s 44.3%.

- 5-15% ROE vs. FY24’s 13.4%.

- 60% DPR vs. FY24’s 50%.

- Additionally, management expects less repricing on both the loan and deposit sides, while looking for a slightly higher loan yield by shifting the loan mix toward more retail lending. They cited higher yields and the bank’s ability to take a riskier approach in FY25.

Summary:

- Overall Performance: BNGA’s performance was neutral, given it had to increase funding costs to meet loan demand, while NP growth was supported by other non-operating income. However, strong loan quality provides a buffer for the bank to reduce its CoC. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

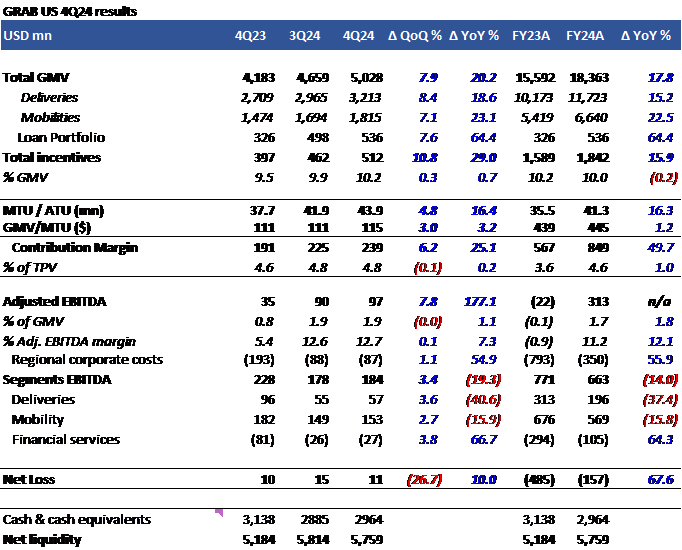

GRAB (Not Rated) - 4Q24/FY24 Result, Acceleration in Indonesian GMV, Faster Than Other Countries

4Q24, Best Quarter Ever as per Anthony Tan

- Grab ODS GMV growing by 20.0%yoy/7.9%qoq to reach US$5bn. Notably, GMV in Indonesia increased by 10%qoq.

- EBITDA improved by 7.8%qoq to US$97mn, resulting in a net profit of US$11mn, marking a positive bottom line.

- FY24

- Total GMV rose by 17.8%yoy to US$18.4bn, driven by solid growth in mobilities (+22.5% yoy) and deliveries (+15.2%yoy). Additionally, the loan portfolio posted robust growth of 64.4%yoy to US$536mn. This strong performance was supported by an increase in MTUs, reaching 43.9mn (+16.4qoq).

- EBITDA reached US$313mn (1.7% of GMV +180bps yoy). Net loss narrowed by 67.6%yoy to US$157mn in FY24.

Organic growth is first priority but not shying away from M&A

- GRAB remains focused on driving organic growth, with M&A considered opportunistically and only when it enhances the strategic ecosystem. Capital deployment for inorganic expansion will be highly selective.

- There is high bar on inorganic opportunities as per GRAB, with organic growth as first priority. There needs to be tangible synergies when it comes to acquisitions, instrumental to their operations. In our view however, they did not deny a case for potential M&A action with Gojek/GOTO.

Other Grab highlights:

- Focus on AI, Robotics and EV are in top of mind; partnership with Bluebird.

- Anthony Tan suggests 2025 will be the year for Asian Tech AI. Merchants will boost sales, recommendations for chefs, ad-spend, user targeting. Also more productivity for GRAB workforce.

Pls refer our GOTO report for potential M&A scenario: https://link.brights.id/brids/storage/37446/20250210-GOTO.pdf (Niko Margaronis & Kafi Ananta – BRIDS)

MARKET NEWS

MACROECONOMY

Indonesia’s Current Account Deficit Narrowed to US$1.15bn in 4Q24

Indonesia's current account deficit narrowed to US$1.15bn in 4Q24, compared to US$1.38bn in the same quarter of 2023. Although it marked the seventh straight quarter of a deficit, it was the smallest shortfall in this period, accounting for 0.3% of the nation's GDP. (Bank Indonesia)

SECTOR

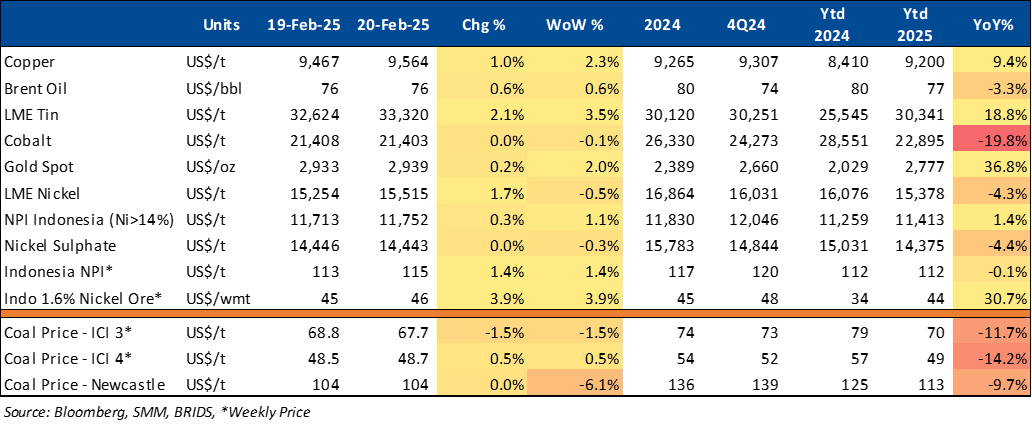

Commodity Price Daily Update Feb 20,2025

Technology: FMCG Sales Growth on TikTok Shop in Feb24 – Jan25

TikTok Shop saw a 34.2% increase in FMCG sales from Feb24 to Jan25, rising from Rp1.69tr to Rp2.27tr. Monthly sales grew by 3.28% on average, with body lotions, face moisturizers, perfumes, and facial serums leading the sales. Bundled products drove much of the growth, as 8 of the top 10 beauty products were sold in bundles. (Bisnis)

CORPORATE

AMMN Seeks Export Permit Extension

AMMN is seeking an extension for its copper concentrate export permit in 2025 due to its smelting operation being only at 48% capacity. The company faces uncertainties in the commissioning process, which has been slow as they take a cautious approach with new technology. If permitted, AMMN could export 200,000 tons of concentrate. (Emiten News)

DeepSeek Seeks Funding, Attracts Interest from Alibaba and National Social Security Fund

DeepSeek is considering external funding for the first time after experiencing a surge in demand for its artificial intelligence models. The company has attracted interest from major investors, including Alibaba and state funds such as China Investment Corp and the National Social Security Fund. To support the development of more complex AI models and meet growing demand, DeepSeek is exploring external funding options to strengthen its capacity and infrastructure. (Bisnis)

ISAT Eases Access for 50Mn MyIM3 Users to Tokopedia-Blibli through Digital Hub

Indosat Ooredoo Hutchison (ISAT) has launched Digital Hub, a new feature on the myIM3 and bima+ apps, making it easier for users to access various services such as Tokopedia, Blibli, and Tiket.com. Additionally, customers can enjoy exclusive benefits, including free data quotas, Celebrity Fitness membership trials, and discounts of up to Rp1mn on flight tickets and hotel bookings. (Bisnis)

TLKM Ready to Participate in Spectrum Auction While ISAT is Still Considering

The President Director of TLKM has confirmed that Telkomsel will participate in the 1.4 GHz spectrum auction. Meanwhile, ISAT is still conducting an in-depth assessment regarding its participation in this auction. Komdigi emphasized that the primary objective of this spectrum selection is to provide affordable fixed broadband services for the public. (Bisnis)

VinFast Offers 3 Years of Free Charging in Indonesia

VinFast Indonesia is launching a promotion offering free charging for up to three years at all VinFast charging stations nationwide. CEO VinFast Asia, stated that owners of the VinFast VF 3 mini SUV can benefit from this offer, potentially saving up to Rp37mn. This strategy aims to attract consumers seeking relief from fuel price uncertainty while promoting smart and eco-friendly mobility solutions in Indonesia. (Bisnis)