FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank Tabungan Negara: FY26 Outlook: Higher Volume and Lower CoC to Offset the Potentially Lower Earning Assets Yield (BBTN.IJ Rp1,095; BUY TP Rp1,300)

- We forecast FY26F net profit of Rp3.2tr (+3.9% yoy) for BBTN, supported by robust loan growth (+9.8% yoy) and lower CoC.

- We see potential NIM upside from KUR housing programs but asset quality risks might arise given its nascent stage.

- Maintain Buy rating with a lower TP of Rp1,300. Risks to our view include weaker asset quality and stagnant CoF.

To see the full version of this report, please click here

Indosat Ooredoo Hutchison: Stepping Into Monetization Phase (ISAT.IJ Rp2,380; BUY TP Rp3,000)

- Dec25 price tracker shows clear intentional price hikes across IM3 and Hutch mainstream packages, supporting yield improvement prospect.

- We raise our FY26F revenue forecast to +5.2% yoy, supported by stronger mobile execution, and meaningful upside to data yields.

- We raise our TP to Rp3,000 (5.3x EV/EBITDA) following initial price-repair; Mgmt. guides fiber divestment completion by year-end.

To see the full version of this report, please click here

XLSmart Telecom Sejahtera: Positioned for Post-Merger Upside (EXCL.IJ Rp3,700; BUY TP Rp4,100)

- Network integration will boost coverage, capacity, and efficiency, hence positioning EXCL for stronger traffic and sustained yield gains.

- We project leverage to drop to 2.8x ND/EBITDA in FY26-27F, reflecting balance-sheet flexibility, supported by the MORA divestment proceeds.

- Maintain Buy rating with a higher TP of Rp4,100, supported by robust post-integration free cash flow of Rp8-10tr p.a. over FY27-30F.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

Banks (Neutral): Key Points of OJK Special Credit Treatment for Aceh, North Sumatra, and West Sumatra (Dec25)

- OJK activated special credit treatment for borrowers affected by floods and landslides in Aceh, North Sumatra, and West Sumatra to prevent systemic risk and support regional economic recovery.

- Measures follow POJK 19/2022, enabling:

- 1-pillar asset quality assessment (based only on payment performance) for loans up to Rp10bn,

- Current classification for restructured loans, whether the credit was given before or after the disaster,

- Encouragement to provide new financing to affected borrowers with separate asset-quality classification (not one obligor).

- The special treatment is valid for up to 3 years from 10 December 2025.

- OJK also instructed the insurance industry to activate disaster-response mechanisms, simplify claims, map affected policies, execute disaster recovery plans, and coordinate with BNPB/BPBD.

- Implication for the banks:

- Banks can classify restructured loans for restructured borrowers as Current.

- NPL ratios are shielded from sudden spikes — especially helpful for micro/SME heavy banks.

- Reduces the need for immediate loan loss provisions, reducing near-term CoC spikes. ( Victor Stefano & Naura Reyhan Muchlis – BRIDS)

MARKET NEWS

MACROECONOMY

|

US Trade Deficit Narrowed Sharply to US$52.8bn in Sep25 The US trade deficit narrowed sharply to US$52.8bn in September, the smallest since mid-2020 and far below forecasts. Exports rose 3% to the second-highest level on record, driven by nonmonetary gold, pharmaceuticals, and financial services, while imports increased a modest 0.6%. The data also showed large swings tied to tariff-related volatility, with a surge in pharmaceutical imports partly linked to President Trump’s tariff threats. Inflation-adjusted figures showed the merchandise deficit at a five-year low, while record gold exports to Switzerland produced the largest-ever bilateral surplus. The gap with China continued to shrink. (Bloomberg) |

SECTOR

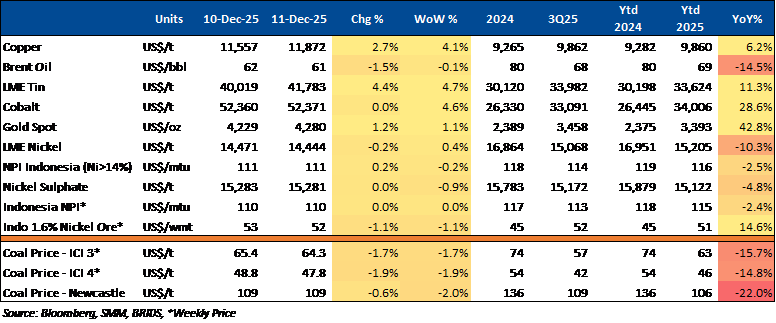

Commodity Price Daily Update Dec 11, 2025

CORPORATE

|

GOTO Launches BPJS Contribution Support Program for Top-Performing Driver Partners GOTO has officially launched a program providing BPJS Ketenagakerjaan and BPJS Kesehatan contribution support for high-performing two-wheel and four-wheel driver partners within the Gojek ecosystem. The initiative will benefit hundreds of thousands of top-performing partners across Indonesia, beginning with 10,000 drivers in Surabaya. Eligibility is based on criteria such as activeness, performance level, and service quality. Drivers in Surabaya classified as “mitra juara” can register starting 11 December 2025, with coverage effective 2 January 2026, while registration for partners outside Surabaya opens on 1 January 2026, with coverage commencing on 2 February 2026. (Investor Daily)

WIKA Secures Rp728bn Contract for West Kalimantan Sekolah Rakyat WIKA obtained a Rp728.44bn contract to build Sekolah Rakyat facilities in Pontianak and Singkawang through a KSO scheme. The 240-day project covers full construction works—including civil, architectural, MEP, infrastructure, landscaping, and furniture—for classrooms, labs, libraries, dormitories, sports areas, and green spaces. (Kontan)

WSKT Speeds Up Probowangi Toll Road WSKT is accelerating the Probolinggo–Banyuwangi (Probowangi) Toll Road Package 3, now 90.66% complete and targeted to open for free during the Nataru holidays to reduce traffic. The 5.8 km segment includes a 450-meter bridge over the Paiton hills, expected to become a new East Java landmark and boost access to major tourist sites like Kawah Ijen and Bromo. (Emiten News) |