FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Ciputra Development: Stable Growth Outlook Despite Lag in Handover Timing Driving Weak 3Q24 Results (CTRA.IJ Rp 1,120; BUY TP Rp 1,700)

- CTRA’s weaker-than-expected 9M24 results were driven by a lag in its handover timing which led to lower accounting revenue bookings.

- We lowered our FY24F-26F pre-sales forecast by -4%, resulting in a conservative 5% CAGR (vs. 5-yrs. hist. avg. of 7%).

- We maintain our Buy rating on the expectation of steady pre-sales for the next 2-3yrs, with an unchanged TP of Rp1,700.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

Indonesia AI Day Event: Key remarks by CEO of ISAT IJ

- Launch of AI platforms:

- Pak Vikram mentioned the launch of 3 platforms by IOH:

- IM3 platinum

- Sahabat AI

- Merdeka Cloud

- Key partners: NVIDIA accelerators and Accenture to build solutions marketplace.

- NVIDIA GB200 is already here in Jakarta. Alliances with BDx, Lintasarta, GOTO.

- Key client: Parliament DPR aiming to clamp down bureaucracy, Pertamina.

- Priority Verticals: Healthcare (Mayapada CEO taking lead), Education n Research, Food security, Mobility n smart cities.

- Expecting large impact in sectors: Agriculture (crop recommendations), Education (personalized learning), Healthcare (improved quality in remotest islands), Rural SMEs.

- Breeding Talent: Aim for 1 million digital talents and 30,000 AI professionals by 2027.

- To award GPU credits

- GPU Merdeka product will credit <USD2,000 for each research insitution and students to use.

- Qualified Industry startups : between US$5k - 15k credits

- SOEs: US$15k - 50k credits for AI prototyping and validation.

The credits plan can be revised according to demand. we have seen the practice of distributing free use in China already for a revenue sharing model potentially if the startup is succesful

- Minister of Komdigi made appearance in support of AI as part of Indonesia Emas and Indonesia Digital 2045.

Our comment:

We understand that IOH is very active in gathering commitment from key players, including NVIDIA (Mr. Huang, who is set to appear later), the government, and is making efforts to build talent. Additionally, there are encouraging signs of identifying problems where AIaaS can be used as a solution. We believe that promoting AI solutions to SMEs and enterprises may boost ICT revenues for IOH in the process. (Niko Margaronis & Kafi Ananta Azhari – BRIDS)

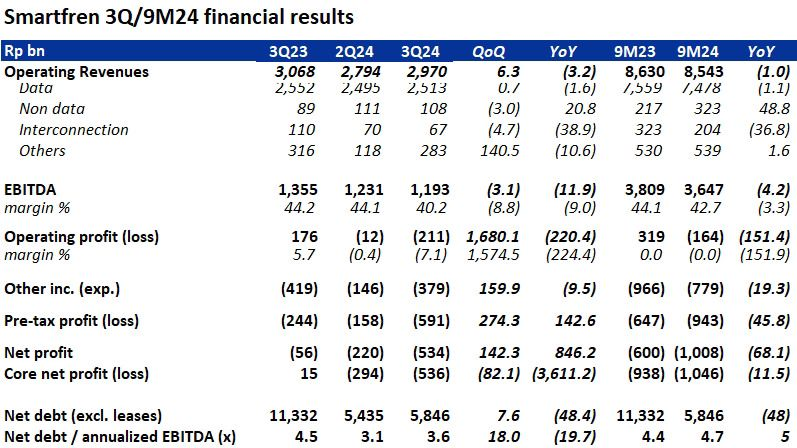

FREN (Not-Rated) Earnings Result 3Q24

- FREN reported a negative earnings result in 3Q24, posting a loss of Rp536bn (-82% qoq), bringing the 9M24 cumulative loss to Rp1,046bn (-11.5% yoy). Revenue grew by 6.3% qoq, reaching Rp2,970bn, but showed flattish growth of -1% yoy, totaling Rp8,543bn for 9M24. The revenue performance was primarily driven by data revenue, which slightly declined by -1.1% yoy for the 9M24 period.

- The subdued revenue growth contrasts with a notable rise in opex, which increased by +13.4% qoq and +4.8% yoy. This mismatch contributed to a decline in EBITDA margin to 40.2%, with the company reporting an operating loss of Rp211bn in 3Q24.

- Debt reduction has been significant, with total debt decreasing by 48% yoy as of 9M24, driven by repayments of bonds payable and long-term loans. As a result, FREN’s net debt stood at Rp5,846bn at the end of 9M24. (Niko Margaronis & Kafi Ananta Azhari – BRIDS)

MARKET NEWS

MACROECONOMY

IEA Forecasts 1 Million BPD Oil Market Surplus in 2025 Due to Softening Chinese Demand

The International Energy Agency (IEA) estimates that the global oil market will face a surplus of more than 1mn bpd in 2025 due to softening Chinese demand. China's oil consumption has contracted for six straight months through September. Next year, global oil consumption will increase by 990k bpd, higher than this year's 920k bpd. However, supplies from producers are set to grow by 1.5mn bpd in 2024 and 2025. (Bloomberg)

SECTOR

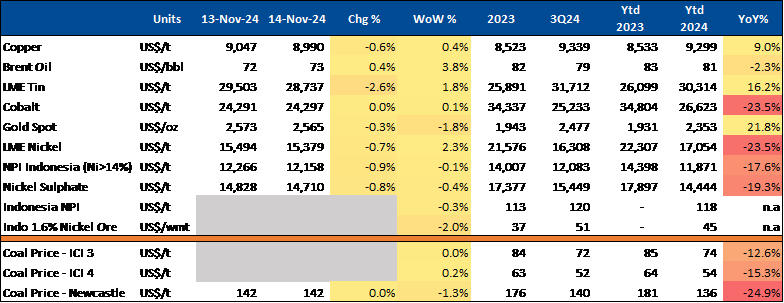

Commodity Price Daily Update Nov 14, 2024

Motorcycle Sales in Indonesia Up 3.42% yoy in 10M24

Motorcycle sales in Indonesia rose 3.42% yoy to 5.4mn units from January to October 2024. In October, sales reached 544,392 units, a 2.97% increase from Sep24. Scooters account for 90.20% of sales, with underbone and sport bikes at 5.41% and 4.38%, respectively. Despite economic uncertainties, stable prices and local production have bolstered the market. AISI expects total sales to reach 6.35mn to 6.45mn units by year-end, driven by seasonal demand and dealer promotions. (Kontan)

Gov’t Delays Copper Export Ban to 2025, Freeport Seeks Further Extension

The government will impose a ban on copper concentrate export permits starting January 2025. This ban was originally scheduled to begin on June 1, 2024, but was postponed until the end of this year as some domestic mining companies were unprepared to comply with the regulation. Despite the extension, many local mining companies, including PT Freeport Indonesia, hope for another delay in the export ban next year. Freeport has requested an extension of its copper concentrate export permit, citing halted operations at its new smelter in Gresik, East Java, following a fire in October 2024. (Kontan)

CORPORATE

BUMI to Conduct Private Placement for OWK Conversion

BUMI will issue 1,413,409 Series C shares through a private placement to convert its Obligasi Wajib Konversi (OWK). The shares, priced at Rp157 each, will be fully subscribed by OWK holders, and the transaction is scheduled for November 21, 2024, with results announced on November 25, 2024. After the conversion, BUMI's total capital will increase to 371.32mn shares, consisting of Series A (20.77mn shares), B (53.50mn shares), and C (297.05mn shares). (IDX)

DRMA Boosts Performance with Automation and EV Battery Investment

DRMA is ready to drive performance in the remaining months of 2024. According to DRMA, the company will improve work efficiency in its production system, including through automation. Recently, through its subsidiary, PT Dharma Controlcable Indonesia (DCI), DRMA has fully automated its battery pack production line. Dharma Group is focused on investing in the production of electric motorcycle battery packs and battery energy storage systems. (Kontan)

Grab and OVO Launch Digital Initiative for Free Nutritious Meals

Grab and OVO are leading a digital initiative to provide free nutritious meals at SD Muhammadiyah 1 Wonopeti in Kulon Progo, DI Yogyakarta. This pilot program focuses on three key areas: utilizing end-to-end technology, ensuring comprehensive food safety and nutrition standards, and measuring the nutritional impact on students, through GSI Lab. The Minister of Education, along with Grab and OVO management, recently visited the school to oversee the program's implementation. (Investor Daily)

MBMA’s Reallocation of IPO Funds for HPAL 1a Construction

MBMA’s EGMS includes a key agenda seeking shareholder approval for reallocating IPO funds initially intended for capital deposits to MIN and loans to SIP, each amounting to 50%. These funds, originally designated for the HPAL 1a construction at IKIP, will now be used for immediate capital expenditure on the HPAL factory due to the ongoing feasibility study. The construction will be financed in stages through financial institutions, instead of using IPO proceeds. (IDX)

TOWR Subsidiaries Extend Credit Agreements

TOWR subsidiaries, Protelindo and Iforte, have agreed to extend the maturity of their credit and foreign exchange facilities with Danamon until December 12, 2024. The transaction is classified as an affiliate transaction under OJK Regulation No. 42/2020 and is not considered a conflict of interest or a material transaction. (IDX)