FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank Mandiri: 3Q24 Earnings: Strong profitability supported by loan growth and asset quality (BMRI.IJ Rp 6,700; BUY TP Rp 8,200)

- BMRI booked a robust net profit of Rp15.5tr in 3Q24, bringing 9M24 net profit to Rp42.0tr (+8% yoy), in line with our and consensus FY24F ests.

- Funding remained challenging, but earnings were supported by strong loan growth and improving asset quality, allowing for a low CoC.

- Maintain Buy with a TP of Rp8,200 derived from GGM model based on 5-year inverse CoE of 10.3%, LTG of 3%, and FY25F RoE of 21.2%.

To see the full version of this report, please click here

Charoen Pokphand Indonesia: Compressed margin in 3Q24, but core profit remained robust amid non-cash losses (CPIN.IJ Rp 5,250; BUY TP Rp 6,400)

- CPIN booked a lower 3Q24 net profit of Rp619bn (-52% yoy, -41% qoq), dragged by lower DOC and LB margin; yet 9M24 earnings were in line.

- 3Q24 net profit was supported by resilient revenues and tax gains but was partly offset by losses in changes in fair value of biological assets.

- We maintain our Buy rating with a TP of Rp6,400 (unch.), reflecting a 30/26x FY24/25F PE ratio.

To see the full version of this report, please click here

Malindo Feedmill: Delivering solid 3Q24 earnings amid margin compression; cheaper options in the poultry space (MAIN.IJ Rp 880; BUY TP Rp 1,700)

- MAIN reported net profit of Rp67bn in 3Q24 (-62% yoy, -67% qoq), in-line with our 3Q24 preview, which expected margin compression.

- Overall margin was dragged by DOC and LB segments, while feed and processed food margin improved on qoq basis.

- On the back of margin recovery expectation in 4Q24, we maintain Buy rating with a higher TP of Rp1,700, implying 8.8-8.6x FY24-25F PE.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

RESEARCH COMMENTARY

- ACES (BUY, TP: Rp1,100) - 3Q24 Results: Broadly In Line to Achieve Our and Consensus FY24 Estimates

- BANK (Non Rated) - Sep24 Results

- BCA Digital (Blu) - Sep24 Results

- BDMN (Non Rated) – Sep24 Bank Only Results

- BSDE (Buy, TP: Rp1,550) – 9M24 Result: In Line with Our and Consensus Estimates

- CTRA (Buy, TP: Rp1,700) - 9M24 Achievement: Below Our and Consensus Estimates

- JSMR (Buy, TP: Rp6,500) – 9M24 Results: Soft 3Q24, but 9M24 Revenue is Still Above Our/Cons Ests.

- ICBP (Buy, TP: Rp13,400) - 3Q24 Results: Slightly Above Consensus Estimates

- INDF (Buy, TP: Rp8,000) 3Q24 Result: Core Profit Broadly In Line with Our and Consensus Estimates

- INTP (BUY, TP: Rp8,800) - 9M24: In Line Results with a Strong qoq Performance From Opex Control, yet Weak ASP

- MEDC (Buy, TP: Rp1,700) - 3Q24 Results: In Line

- MIDI (Buy, TP: Rp600) - 3Q24 Results: Broadly In Line, With non-Java Driving Growth

- PRDA (Under Review) – 9M24 Achvievements: In Line with Consensus Estimates

- SMGR (Hold, TP: Rp4,100) - 9M24: Huge Miss yet ASP is Improving

- SSIA (Buy, TP: Rp1,400) - 9M24 Earnings: Soft Achievement Expected as BYD Land Sales Handover is Scheduled in 4Q24

- Superbank – Sep24 Results

- TBIG (Buy, TP: Rp2,500) – 9M24 Results: In Line

- TOWR (Buy, TP: Rp1,400) – Broadly In Line with Consensus. Key Highlights Include Strong EBITDA Performance, Maintaining Stable Leverage

MARKET NEWS

MACROECONOMY

|

BPS will Announced October's inflation Today, Expecting Inflation to Reach 1.60% BPS will announce October's inflation today at 9 am. We expect inflation to reach 1.60% (vs. Cons: 1.66%), lower than September's 1.84% due to declining food prices. For core inflation, we expect it to reach 2.17% (vs. Cons: 2.08%), an acceleration from September's 2.9%. (BRIDS Economic Research)

China's Manufacturing Sector Expands in October China's manufacturing expanded slightly in Oct24 with a PMI of 50.1 (vs. 49.8 in Sep-24), according to the NBS figure. It marks the first expansion since Apr-24 as output grew for the second consecutive month amid stimulus measures. (Trading Economics) |

|

Eurozone Inflation Rises to 2% in Oct24 Eurozone's inflation rate accelerated to 2% in Oct24, higher than the consensus of 1.9% and September's 1.7%. The figure is in line with the ECB's expectation of accelerating inflation until the end of the year due to the base effect, before declining back to 2% in 2025. (Bloomberg)

The Bank of Japan Maintains Key Rate at 0.25% in Oct24 The Bank of Japan (BoJ) held the key short-term rate steady at around 0.25% in October's meeting. BoJ is sticking to its view that it’s on track to achieve its inflation target, an outlook that points to the possibility of another rate hike in the coming months. (Bloomberg)

US Core PCE Increased 0.3% mom in Sep24 US Core PCE increased 0.3% mom in Sep24, and 2.7% yoy. The monthly gain was the highest since April. Overall inflation was 2.1%, the lowest since early 2021 and just above the central bank’s 2% goal. (Bloomberg) |

SECTOR

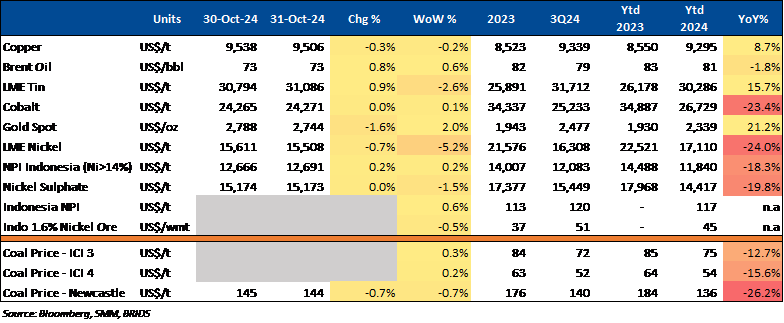

Commodity Price Daily Update Oct 31, 2024

|

Evaluation of Electric Motorcycle Subsidies in Indonesia The government is set to evaluate the effectiveness of the Rp7mn/unit subsidy for electric motorcycle purchases before continuing the program next year. The Coordinating Minister for Economic Affairs stated that discussions will take place soon. For 2024, the subsidy quota is established at 50,000 units, with an additional 10,700 units added in Aug24. The Ministry of Industry has announced that the subsidy will be extended until 2025 and has coordinated with the Ministry of Finance. Meanwhile, the Indonesian Electric Motorcycle Industry Association remains optimistic that the total population of electric motorcycles will reach 200,000 units by the end of this year, despite concerns over the potential removal of subsidies. (Bisnis) |

Rapid Growth in Electric Vehicle Financing Amid Industry Challenges

Financing for electric vehicles (EVs) has surged significantly, with PT Mandiri Utama Finance (MUF) reporting disbursements of Rp682bn as of 9M24, a 368% yoy increase. Despite this growth, electric vehicles still represent only 4.3% of the company's total financing. Challenges such as charging infrastructure and uncertain resale values persist, but optimism remains due to rising environmental awareness and government incentives. Similarly, Adira Finance reported Rp290bn in electric vehicle financing, reflecting a 136% yoy growth, while emphasizing the need to diversify beyond automotive financing amid industry challenges. (Bisnis)

SKK Migas Accelerates Target for Geng North Onstream

The Special Task Force for Upstream Oil and Gas Business Activities (SKK Migas) aims for the Geng North field to be onstream before 2027. This target is ahead of the initial plan set for the second quarter of 2027. The operation of the Geng North field is expected to strengthen the national oil and gas sector. (Kontan)

CORPORATE

BRIS and Askrindo Syariah Collaborate on Counter Bank Guarantee

BRIS and PT Jaminan Pembiayaan Askrindo Syariah (Askrindo Syariah) have entered into a strategic collaboration for a counter bank guarantee valued at Rp1tr. This partnership aims to strengthen the synergy between financial institutions in providing financing guarantees through counter bank guarantees. The collaboration agreement was signed at the Indonesia Sharia Economic Festival (ISEF) 2024. (Investor Daily)

GOTO to Withdraw 10.26bn Treasury Shares

GOTO has announced plans to withdraw 10.26bn treasury shares, expected to be completed by early November 2024. According to GOTO, this withdrawal will reduce the total number of GOTO shares in circulation by 10bn. These shares were repurchased before the IPO and those acquired by GOTO through the implementation of the company's stock price stabilization program after the IPO, known as greenshoe. (Bisnis)