FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Bank Rakyat Indonesia: 4M24 earnings aided by other operating income, improving CoC should ease asset quality concerns (NOT RATED)

- BBRI reported 4M24 NP of Rp17.8tr (+4% yoy) with PPOP growth of 15% supported by higher other op. income and 12% loans growth.

- Off 1Q24’s high base CoC of 3.7% (Feb24’s CoC was 6.7%), BBRI’s CoC improved to 3.3%. This should ease asset quality concerns.

- The bank’s share price has declined by 28% since Mar24, bringing its PBV to slightly below mean and implied CoE to 11.1% (close to -2SD).

To see the full version of this report, please click here

To see the full version of this snapshot, please click here

RESEARCH COMMENTARY

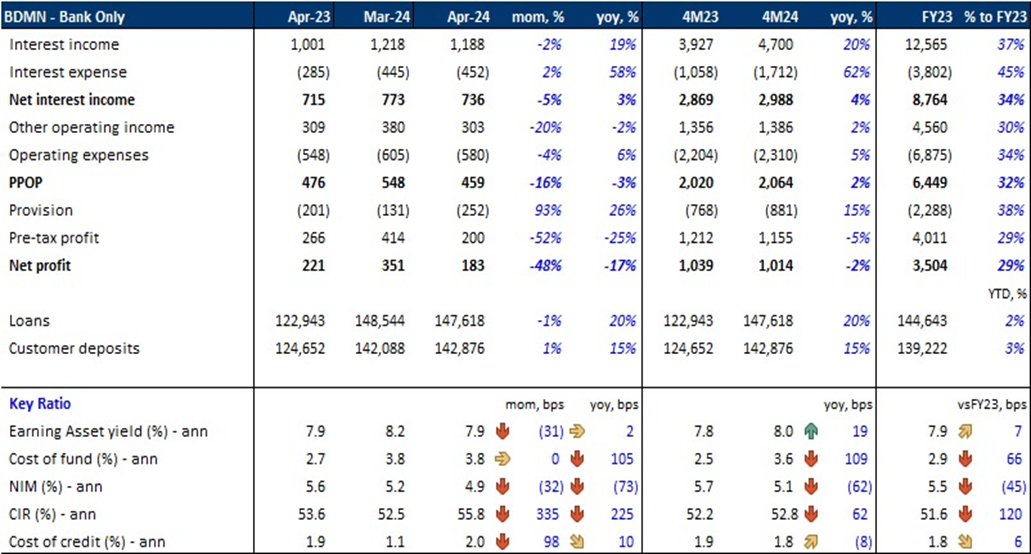

BDMN Bank Only Apr24 Results

- BDMN reported net profit of Rp1.01tr (-2% yoy) in 4M24 reflecting a 15% increase in provisions to Rp881bn as loans grew 20% yoy to Rp147.6tr, which resulted in a flat CoC of 1.8%.

- Despite the improvement in the EA yield to 8.0% (+19bps yoy), NIM was recorded at 5.1%, 62bps lower yoy as the CoF rose significantly to 3.6% (+109bps yoy).

- In Apr24, NP reached Rp183bn (-48% mom, -17% yoy) as provisions and CIR increased to Rp252bn (+93% mom, +26% yoy) and 55.8% (+335bps mom, +225bps yoy), respectively.

- NIM, in Apr24, fell to 4.9% (-73bps yoy) as a result of a 105bps yoy increase in the CoF to 3.8% as CASA declined to 46.9% (-1,017bps yoy). On the other hand, the CoF remained flat on a a monthly basis.

- Loans and customer deposits grew 20% and 15% yoy, respectively, which led to an LDR of 103.3% (+469bps yoy). However, on a monthly basis, both loans and customer deposits growth remained flat.

- Compared to FY23, a flat EA yield and a 66bps higher CoF resulted in a 45bps lower NIM in 4M24. Furthermore, CIR was 120bps higher than in FY23. (Victor Stefano & Naura Reyhan Muchlis – BRIDS)

MARKET NEWS

MACROECONOMY

US 1Q24 GDP Growth is Revised to an Annualized Rate of 1.3% yoy

US 1Q24 GDP growth is revised down to an annualized rate of 1.3% qoq from 1.6% in the first estimate. The downward revision reflects slower consumer spending (2% vs 2.5%). (Bloomberg)

SECTOR

Automotive: Subsidies for Electric Motorcycle Purchases Have Been Disbursed for 30,083 Units

The two-wheeled Battery-Based Electric Motorized Vehicle (KBLBB) Purchase Assistance as of 27 May 2024 has been distributed for 30,083 units of electric motorcycles or 60.1% of the 2024 sales target of 50,000 units. This purchase assistance program is expected to continue to encourage the development of the Electric vehicle ecosystem in Indonesia. The Ministry of Industry expects the purchase assistance quota of 50,000 units for two-wheeled KBLBB to be achieved in Aug24 or early Sep24. (Emiten News)

CORPORATE

CLEO to Distribute Dividends of Rp60bn

CLEO plans to distribute dividends of more than Rp60bn or around 20% of its 2023 net profit. This year, CLEO will expand in several regions in Indonesia so that by the end of 2024 the Company will have 35 factories operating in total. For the purpose of this expansion, the Company has budgeted Capex in 2024 of Rp450bn. (Emiten News)

KLBF is Ready to Acquire 49% of Alliance Pharma Co Shares to Expand its Drug Business

KLBF, through its subsidiary Kalbe International Pte Ltd, has signed a transaction agreement to acquire 49% of Alliance Pharma Co shares. The acquisition is expected to increase market penetration and the availability of Kalbe products in Southeast Asia, particularly Thailand, by leveraging Alliance Pharma's market knowledge and the Kalbe portfolio. The transaction plan is expected to be effective within one month. (StockWatch)

MEDC to Distribute Dividends of US$70.05mn

MEDC has agreed to distribute total dividends of US$70.05mn for FY23, including an interim dividend of US$25mn and a final dividend of US$45mn, which will be paid in rupiah according to the exchange rate in effect on June 28, 2024. Shareholders also approved the audited Annual Report and Financial Statements for FY23, the remuneration of the Board of Commissioners and Directors, and the appointment of a financial auditor for FY24. (Emiten News)

PGAS to Distribute Dividends of Rp148/Share

PGAS has decided to distribute dividends totaling US$222.43mn or around Rp148/ share (yield: 9.1%). The company will also provide natural gas networks for households, small customers and utilize Gas Fuel (BBG) for road transportation. (Emiten News)

TBIG to Distribute Dividends of Rp1.25tr

TBIG will distribute Rp1.25tr or 80% of its profit for FY23 as dividends. Including the Rp565.9bn distributed as interim dividends on 27 Dec23, the final cash dividend will be Rp683.6bn or Rp30.20/share (yield: 1.6%). The recording date is June 11, 2024, and the cum dividend date is June 7, 2024. (Emiten News)