FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Towers: Building retail channels to invigorate supply and demand for fixed broadband (OVERWEIGHT)

- We see a significant untapped inventory in fixed BB despite the low user penetration, implying a large fragmentation in the supply chain.

- Smaller infra ISPs may disrupt the market by offering more affordable prices of Rp100-Rp200k/month, owing to their leaner cost structures.

- Maintain OW rating in infra/towers; lower prices may unlock the supply chain and improve segmentation; TOWR should be the key beneficiary.

To see the full version of this report, please click here

Bank Central Asia: FY24 Results: in-line, solid asset quality and NIM aided in navigating the tight liquidity environment (BBCA.IJ Rp9,600; BUY TP Rp11,900)

- Despite the challenging year, BBCA booked NP of Rp54.8tr in FY24 (+13% yoy), in line with our and consensus estimates.

- 4Q24’s NP declined 3% qoq on the back of higher opex and higher effective tax rate, partly offset by a reversal on Cessie.

- We revised our FY25/26F EPS est. by +1.5/-0.3% and maintain Buy rating with a higher TP of Rp11,900. BBCA remains our top pick in the sector.

To see the full version of this report, please click here

To see the full version of this snapshoot, please click here

MARKET NEWS

MACROECONOMY

Indonesia: President Prabowo Mandates Fiscal Savings Amid Rp50.6tr Cut in Regional Transfer Budget

President Prabowo has mandated fiscal savings in regional government budgets in respond to a reduction in the Regional Transfer (TKD) budget by Rp50.6tr. Through a presidential directive, he called on regional governments to reduce official travel expenses by 50%, cut costs related to ceremonial activities, and minimize other non-essential expenditures. (Bisnis)

SECTOR

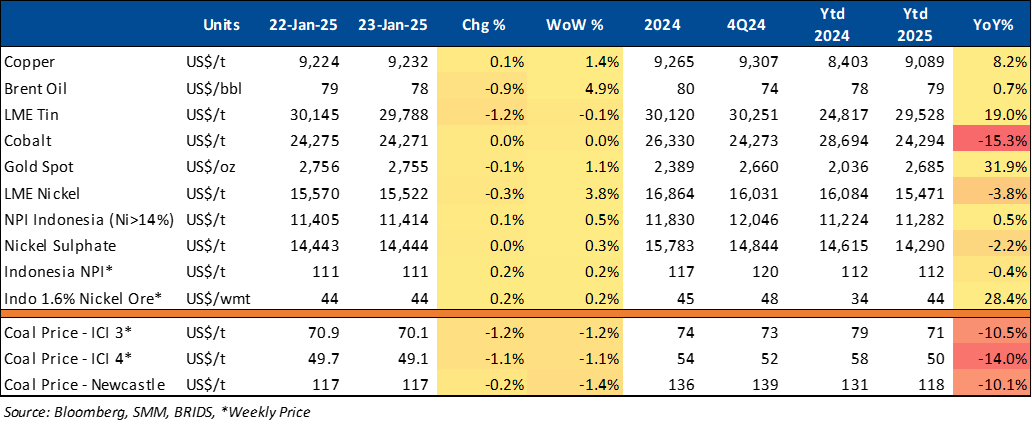

Commodity Price Daily Update Jan 23, 2025

Indonesian Government Confirms Increase in Specific Gas Price (HGBT)

The Indonesian government has agreed to extend the policy of the Specific Gas Price (HGBT) specifically for the industrial sector. However, it is confirmed that the new HGBT will see an increase (no longer at US$ 6 per MMBTU). According to the Minister of Energy and Mineral Resources (MEMR), the HGBT will no longer be set at US$ 6 per MMBTU due to the rising price of natural gas. Additionally, the raw material cost of gas is lower compared to the price of gas used for energy. Under the government’s plan, the price of gas used for energy is expected to be around US$ 7 per MMBTU, while the cost of raw material gas is projected to be below US$ 7 per MMBTU. (CNBC Indonesia)

Property: Secondary House Price Index Slows by 0.5% - 2.7% Throughout 2024

According to Rumah123's January 2025 Flash Report, the growth of the Secondary House Price Index in 2024 slowed, ranging from 0.5% to 2.7%. This was lower than the growth range in 2023, which was between 2.2% and 4.3%. The lowest growth in 2024 occurred in April, while the highest was in January. (Kontan)

CORPORATE

BREN Partners with SLB to Advance Geothermal Technology Development

BREN, through Star Energy Geothermal, has teamed up with SLB to accelerate advanced geothermal technology development. The collaboration combines Star Energy's geothermal expertise with SLB's decades of experience in energy technology, aiming to improve the economics and recovery rates of geothermal projects. (Kontan)

Hindustan Unilever to Acquire Minimalist Skincare Brand

Hindustan Unilever Limited plans to acquire the skincare brand Minimalist. The maker of Dove and Pears soap brands announced that it will purchase 90.5% of the shares in Uprising Science, which operates under the 'Minimalist' brand. According to Reuters, the acquisition, including debt, is valued at 29.55bn rupees, approximately Rp5.55tr. Hindustan Unilever stated that the deal with Uprising Science is expected to close in the April-June quarter. (Kontan)

ISAT Partners with Xanh SM to Boost EV Growth in Indonesia

ISAT has partnered with Xanh SM to support the rapid growth of Indonesia’s EV industry. The collaboration facilitated by ISAT business, aims to integrate ICT, IOT, and analytics to develop smart mobility solutions in Indonesia. The partnership will start with a 6month pilot case. (Tech in Asia)

SMRA Targets Rp5tr in Marketing Sales for 2025

SMRA aims to achieve Rp5tr in marketing sales in 2025, a 15% increase from last year's Rp4.36tr. SMRA believes the extension of the VAT exemption on home purchases will boost performance this year. However, the company is mindful of economic challenges, including concerns over the potential impact of Donald Trump's election as U.S. President, which could lead to changes in U.S. Federal Reserve policies. (Kontan)