FROM EQUITY RESEARCH DESK

IDEA OF THE DAY

Metal Mining: Aug24 Metal Sector Update: supports for tin price; nickel ore tightness persists (OVERWEIGHT)

- Tin price strengthened to US$32k/t in Aug24, as inventory (SHFE and LME) and Indonesian exports fell -23% mom.

- Nickel ore supply remained tight, which boosted the NPI price in Aug24. However, the LME price fell on weaker fundamentals.

- We reiterate our Overweight rating on the sector, with TINS and NCKL as our top picks due to stronger earnings visibility.

To see the full version of this report, please click here

Bank Negara Indonesia: Inline 2Q24 results: improving NIM supported by strong loan growth, higher LDR, and contained CoC (BBNI.IJ Rp 5,275; BUY TP Rp 6,700)

- Supported by a 12% yoy loan growth, BBNI reported 2Q24 NP of Rp5.4tr, bringing its 1H24 NP to Rp10.7tr (+4% yoy), inline.

- The management revised up its loan growth target to 10-12% and lowered CoC target to c. 1%, but expects a lower NIM of >4.0% in FY24.

- Maintain Buy rating with a lower TP of Rp6,700 based on inverse GGM with a CoE of 10.1% (5-year mean) and FY24F ROE of 13.8%.

To see the full version of this report, please click here

To see the full version of this snapshot, please click here

MARKET NEWS

RESEARCH COMMENTARY

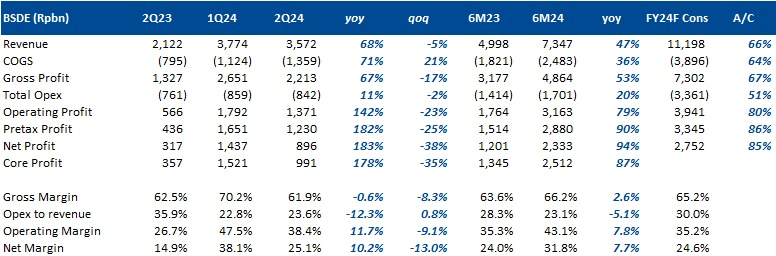

BSDE 1H24 Results: Above Cons Estimates

- BSDE booked Rp896bn of net profit in 2Q24 (-38%qoq; +183%yoy), bringing its 1H24 achievement to Rp2.3tr (+94%yoy), 85% of cons. estimates (i.e. Above).

- Revenue reached Rp7.3tr in 1H24 (+47%yoy), driven by the land and buildings segment (+70%yoy; 81% contribution), which should be attributed by the start of FY23 marketing sales recognition (Rp9.5tr; consist of Rp5tr residentials, Rp2.6tr commercials, and Rp1.87tr JV land sales). The VAT-exempted marketing sales in 1Q24 of ~Rp560bn should also converted into the 1H24 revenue.

- There is yet any impact on the F/S from SMDM upcoming acquisition plan. We are currently reviewing our numbers to incorporate the 1H24 results, and cons. should also adjust its revenue recognition forecast for FY24F. (Ismail Fakhri Suweleh & Wilastita Sofi - BRIDS)

SMGR Jul24 Data

- SMGR recorded sales vol. of 3.7Mt in Jul24 (+11% mom/-6.1% yoy), bringing 7M24 sales vol. to 21.2Mt (-2% yoy) - 52% of our estimate (slightly below of seasonality of 55% in Jul).

- Domestic sales vol. recorded at 2.9Mt in Jul (+8% mom/+0.7% yoy), bringing 7M24 domestic sales vol. to 17Mt (-1.1% yoy). The bulk segment was somewhat stronger in Jul24, with bag ratio falling to 68.3% vs. the average of 70% in Jan-Jun24. SMGR market share was relatively stable at 49.3% in Jul24 vs. Jan-Jul avg of 49.8%.

- Albeit slightly lower than our estimate (vs. inline INTP sales vol to our estimate), Jul24 was a month with strong momentum for cements, including SMGR and INTP. Bag pricing was also relatively stable for SMGR and INTP, based on our tracker. Monthly momentum was better for INTP (+23% mom) vs SMGR (+11% mom). We continue to prefer INTP over SMGR in the cement sector. (Richard Jerry, CFA & Christian Sitorus – BRIDS)

TINS 2Q call KTA

- 1H Cash cost was maintained at US$17.7k/ton, although slightly higher compared to US$17.2k/ton, which we believe is linked to the higher LME tin price.

- Although TSL Ausmelt went back to operation by August, management sees only limited cash cost improvement in 3Q, whilst aiming for a notable decline in 4Q.

- July sales figures might be lower due to the implementation of SIMBARA; thus, we should expect stronger sales in August onwards.

- Management estimates private smelter's RKAB amounting to 15kt vs TINS' 30kt. Thus, 6M24 national export volume of 14.4kt is still in line with RKAB. (Timothy Wijaya – BRIDS)

MACROECONOMY

Global: Composite PMI in Aug24

Composite PMI in Aug24, a combination of manufacturing and services PMI, are all expanding in major countries, according to the preliminary release. Australia, Japan, Eurozone, and UK have higher composite PMI figures compared to last month, while US’ is relatively unchanged. The strong PMI came from robust service sectors, while manufacturing sectors in some advanced countries are still contracting. (Trading Economics)

Indonesia Current Account Deficit Widened to US$3bn in 2Q24

Indonesia Current Account deficit widened to US$3bn in 2Q242 (0.9% of GDP) from US$2.4bn in 1Q24. It marked the highest deficit since 2020 and reflected the pressure on IDR. Bigger service trade deficit (US$5.1bn vs. US$4.2bn) weighed on the current account balance. Primary income deficit also widened to US$9.3bn on the back of repatriation seasonality. (Bank Indonesia)

US Jobless Claims Average Falls for Second Consecutive Week After August Spike

US 4-week average of weekly jobless claims fell for the second straight week, following a spike in the early August. (Trading Economics)

SECTOR

Automotive: The Government is Waiving the Cost of Converting to Electric Motorcycles

The Ministry of Energy and Mineral Resources (ESDM) has launched a free program to convert 1,000 gasoline motorcycles to electric motorcycles, targeted at the Jabodetabek area. The ESDM Ministry reported that there have been 788 applications for the gasoline-to-electric motorcycle conversion program. Currently, 592 units are undergoing the conversion process, and 196 units have already received subsidy assistance.

CORPORATE

EXCL Adds 22 BTS Units in Nusa Penida and Nusa Lembongan

EXCL continues to expand and improve network quality in Nusa Penida and Nusa Lembongan, Bali by adding 22 base transceiver station (BTS) units. According to EXCL, these two islands are among the popular tourist destinations and attract many visitors. Besides the growing number of tourists, local activities have also contributed to an increase in the demand for EXCL's internet services. In the past two years, traffic has increased by 99% on both islands. (Investor Daily)

MTDL Absorbed Capex of Rp134bn in 1H24

MTDL has absorbed capital expenditure of Rp134bn in 1H24. According to MTDL, the capex budget for 2024 is Rp330bn. In detail, Rp200bn is allocated for IT rental equipment, commonly used in the oil and gas sector. Additionally, there is an expansion of a new warehouse valued at Rp120bn, and an upgrade of IT equipment amounting to Rp10bn. (Kontan)

PGEO Partners with NEXI for Project Financing Insurance Guarantee

PGEO has partnered with Nippon Export and Investment Insurance (NEXI), a Japanese government-owned insurance company. This partnership was formalized with the signing of a Memorandum of Understanding on August 20, 2024, for insurance guarantees on the financing of several PGEO projects. One of the highlighted opportunities in this agreement is the insurance guarantee for financing the Lahendong 7 & 8 projects. (Bisnis)