|

Poultry: Regulation remains supportive (OVERWEIGHT) Via a regulation issued on 24 Aug-23, the government seeks to continue stabilizing livebird prices by cutting PS aged 50-54 weeks and HE aged 19 days. We estimate the supply reduction per month at around 69.4 million DOC FS during the Oct-Nov period, slightly lower than the 72.5 million during Aug-Sep. As such, we believe DOC and livebird prices will remain stable in 4Q23. We remain Overweight on the sector with CPIN as our top pick. To see the full version of this report, please click here

To see the full version of this snapshot, please click here

MARKET NEWS |

|

||

MACROECONOMY

US Consumer Confidence, House Price Index, and Job Openings

US Consumer confidence declined more than predicted to 106.1 from a downwardly revised 114.0 in August, following two consecutive monthly improvements amid increasing inflation fears. US house prices up 3.1% y-y/0.3% m-m in June 2023, following a 2.9% y-y/0.7% m-m increase in May. Job vacancies fell 338,000 to 8.827 million in July as the job market progressively declines, the lowest level since March 21. (Bureau of Labor Statistics, FHFA)

Indonesian Government Gives Electric Motorcycle Subsidies of IDR7 mn for 1 KTP Per Unit

The government has issued a policy regarding expanding subsidy receipts for the purchase of Two-Wheel Battery-Based EV through the release of Permenperin No. 21 of 2023 on Amendments to Permenperin No. 6 of 2023 on Guidelines for Government Assistance in the Purchase of Two-Wheel Battery-Based EV (KBLBB). In this regulation, it is stated that the subsidy program is given for a one-time purchase of Two-Wheel Battery-Based EV by the public with the same identification number (NIK). (CNBC)

CORPORATE

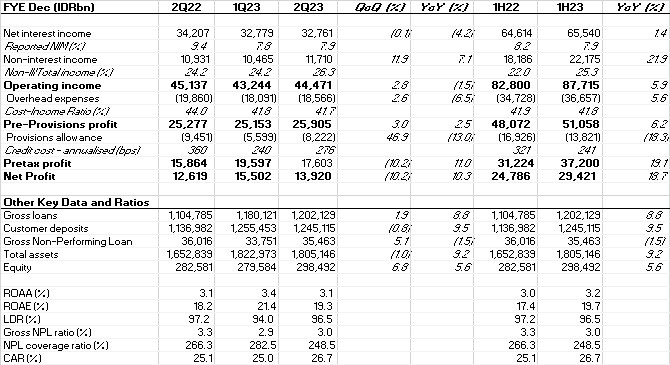

BBRI IJ: 1H23 result highlights

- BBRI posted IDR29.4tn net profit in 1H23 (+18.7% yoy), inline with cons (50.1% of FY23F) driven by +8.8% yoy loans and financing growth with lower CoC of 241bps (1H22: 321bps) despite a slippage in NIM by c.30bps to 7.9% owing to higher blended CoF.

- On quarterly basis, 2Q23’s earnings of IDR13.9tn (+10.3% yoy, -10.2% qoq) due to higher CoC of 276bps (1Q23: 240bps), a 1.9% qoq loans and financing growth and an uptick in NIM to 7.9% (1Q23: 7.8%).

- Asset quality wise, gross NPLs ratio stood at 2.9% in Jun-23, flattish on qoq yet improved on yoy (Mar-23: 2.9%, Jun-22: 3.3%), with a lower LaR of 14.9% to total loans book and fairly stable LaR coverage of 49.1% compared to Mar-23’s position.

- Micro and ultramicro segment grew by 11.4% yoy and 2.6% qoq, brought the contribution up to 48.1% to total loans from 47.0% in Jun-22, mainly supported by PNM’s at 18.6% on yoy while on qoq basis supported by BBRI’s micro loans figure at 2.8%.

- Currently BBRI trades at 2.4x PBV multiple and 19.6% ROE 24F using cons figures. (Eka Savitri – BRIDS)

EXCL 4G BTS Reaches Alor, NTT

EXCL is intensively building a 4G BTS network to remote rural areas and small islands, including NTT, where the company has added more than 120 4G BTS in the last year. EXCL’s 4G network in NTT is supported by more than 850 units of 4G BTS. Of the total sub-districts, around 188 sub-districts in 22 cities/regencies (60%) have been served by the 4G BTS network. Moreover, Alor Island and its surroundings are one of the targets for strengthening the 4G network in NTT. Currently, 30 units of 4G BTS support EXCL’s network in Alor Island. (Investor Daily)

NCKL Production Targets and Expansion Plan

NCKL is optimistic that it will reach its production target this year based on the 1H23 results, which aligns with the set target. NCKL targets the production of 90,000 tons of Feronickel (FeNi) and 50,000 tons of mixed hydroperoxide precipitate (MHP). Furthermore, Refinery High-Pressure Acid Leach (HPAL) recorded a 22% increase in sales. (Kontan)

Additionally, NCKL has several plans for expansion next year. NCKL is currently calculating investment and total capacity for managing two new mines targeted to begin exploration in 2024. (Bisnis)

PTBA IJ: 1H23 Result Highlights - Below ours and consensus

- PTBA recorded earnings of IDR2.7 tn, down 54.9% yoy, which was 32.3%% to ours and 38.5% to consensus, on the back of lower revenue and margins compression across the board.

- Revenue still improved by 2.4% yoy to IDR18.8 tn due to improving sales volume.

- On quarterly basis, earnings grew 38.7% qoq to IDR1.6 tn supported by lower COGS (-13.2% qoq) and opex

(-53.3% qoq).

TOWR’s Subsidiaries Secures BMRI Credit Facility Worth IDR1.5 tn.

A subsidiary of TOWR obtained a credit facility from BMRI worth IDR1.5 tn. The credit facility was given to Protelindo and Iforte, with SUPR as the insurer. The credit facility is divided into two. Facility A can only be used by Protelindo and is worth IDR1 tn. Meanwhile, Facility B can only be used by Iforte and is worth IDR500 bn. The final maturity date of the credit facility is 12 months from the date of signing the credit and underwriting agreement. The credit agreement was signed on August 28, 2023. (Kontan)

WIFI Rights Issue to Increase Capital

WIFI will increase capital with rights issue. According to WIFI, the company would issue a maximum of 2,003,014,080 ordinary shares with a value of IDR100 per share, which represents 44.44% of its issued and paid-up capital after the rights issue. Additionally, Investasi Sukses Bersama (ISB) stated that it would transfer a total of 903,933,360 preemptive rights to Investasi Maju Makmur (IMM), which is a controlled entity of ISB with 99.99% share ownership. (Emiten News)