|

Strategy: Expanding Policy Arsenal The BI Rate has been kept unchanged at 5.75% for the seventh consecutive month, with a high probability of being maintained until year-end. BI continues to demonstrate flexibility in policy choice by adapting to the evolving market conditions, introducing SRBI, new instrument which will not only deepen the financial system but also could attract foreign flows. Given that the elevated Monetary Operations to reduce IDR volatility could risk IDR domestic liquidity, government fiscal spending acceleration is increasingly crucial to maintain growth momentum toward year-end. To see the full version of this report, please click here

PT Hillcon Tbk: One of a kind (HILL.IJ IDR 2,940 BUY.TP IDR 3,800) Hillcon provides full-service coal & nickel mining contracting services. Given the favorable macro dynamics in Indonesia’s nickel mining industry, the company will focus more on being a nickel mining contracting services provider in the future. The company posted strong revenues growth of CAGR 35.6% in 2020 – 2023. We initiate coverage on HILL with a BUY call and target price of IDR3,800. To see the full version of this report, please click here

To see the full version of this snapshot, please click here

MARKET NEWS |

|

||

MACROECONOMY

Bank Indonesia Leave the BI7DRR Unchanged at 5.75%

Bank Indonesia continue to leave the BI7DRR unchanged at 5.75%. BI deemed the current level is still sufficient to contain inflation within their target range in 2023 and 2024. BI expect inflation to reach 2.9% by the end of 2023 while core inflation to reach 2.5%. (Bank Indonesia)

SECTOR

Telco stakeholders sharing session, more collaboration, FMC, security, and waiting for ASO to finish.

Leadership from every telco took the stage yesterday to express their expectations and concerns during event organized by detik.com.

- B. Sigit, Telkom: FMC to be accessible by the community. (we understand mass market).

- Pak Bogi, Telkom raised importance of collaboration to improve the digital security system. In addition the talent of human resources needs to increase.

- Ibu Dian, XL: FMC is the future revenue growth opportunity that will turn the telco into a tech company. Calling for stakeholders collaboration. It is feared that Elon Musk's Starlink satellite internet service will disrupt the business continuity of domestic telecommunications operators asking government to intervene. Such problems are found in other countries where regulators favor domestic operators.

- Pak Danny, IOH: Indonesia data prices are at the bottom 10 (in the world we think), and is bound to affect quality of the service. Internet users to be wise in using cellular data quota.

- Pak Merza, Smartfren: Calls for deeper ISP Collaborations due to rapid rapid digitalization. Additionally called for driving education of people for internet use. Called for stakeholders collaboration.

- Regulator: Pak Ismail, Director General Kemkominfo. Importance of building a healthy internet culture. Prevent internet users from the negative effects and habits such as hoaxes, online fraud and gambling. Protecting the security and privacy of user data amid future cybersecurity threats.

- Kemkominfo revealed that the 700 MHz frequency auction will be carried out when Analog Switch Off (ASO) has been fully completed. When ASO has been fully carried out, it will generate a digital dividend of 112 MHz, where it is planned that around 90 MHz will be allocated for telecommunications needs.

- Incentives are considered to be provided to telcos but need to be targeted.

Menkominfo Minister Pak Budi: Asset utilization, "One of them is the Palapa Ring fiber optic backbone network asking for more penetration. Also asked for implementation of 5G network technology in 11 priority locations and Internet of Things (IoT).

Pak Jokowi has ordered for the completion of the telco infra project in remaining 1.5 years of him term, asking the latest Director of BAKTI to supervise for this completion. It includes more network in East, construction of sky toll infrastructure, Satria satellites and Hot Backup Satellite (HBS).

CORPORATE

BBNI IJ (BUY, TP IDR12,000): 7M23 result highlights

- 7M23’s net profit of IDR12.1tn (+13.9% yoy), inline with our/cons forecast (55.6/57.4% of FY23F) mainly driven by 6.9% yoy loans growth in Jul-23, lower annualized credit costs of 141bps and 1.5% yoy opex growth.

- NIM considered to be flat at 4.7% in 7M23 due to the offset impact from higher asset yields by 83bps to 6.9% and 87bps increased in CoF to 2.4% based on our calculation.

- On mom basis, Jul-23’s bottom line grew by 4.6% mom thanks to lower annualized CoC of 149bps (Jun-23: 188bps). While CASA deposits were contracted by 3.3% to IDR512.8tn as of Jul-23. We also expect BBNI would not aggressively offer high TD rate given flat mom loans growth.

- We maintain our FY23F forecast with net profit of IDR21.8tn (+19.2% yoy) driven by 8.8% yoy loans growth, a 22bps NIM expansion to 4.8% and lower credit costs of 149bps (FY22: 187bps). Currently BBNI trades at 1.1/1.0x 23/24F PBV, provide ample upside from our GGM-derived TP of 1.4x. (Eka Savitri – BRIDS)

BBNI Inject IDR400 bn. Capital into BNI MF

BBNI executed the injection of IDR400 bn. capital into BNI Multi-Finance. This action was intended to strengthen BNI MF’s capital and support the transformation being carried out by BNI MF to focus on the consumer segment. Due to the injection of capital, BBNI’s share ownership in BNI MF increased to 99.997% from 99.994% previously. (Emiten News)

BMRI IJ: 7M23 result highlights

- Net profit in 7M23 touched IDR27.4tn (+26.5% yoy), inline with our/cons expectation (56.3/56.2% of FY23F) driven by +10.2% yoy loans growth, lower CIR of 33.3% (7M22: 35.3%) and a declined in CoC to 85bps (7M22: 110bps).

- Profitability wise, NIM uptick by c.10bps at 4.5% as asset yields also elevated by 56bps given BMRI already selectively repriced up its lending rate since 2H22. Blended CoF elevated in more manageable way by 46bps to 1.7% thanks to yoy strong CASA deposits growth of 17%, translate higher CASA deposits contribution of 78.3% to total customer deposits in Jul-23 (Jul-22: 75.8%).

- On monthly basis, Jul-23’s only earnings of IDR4.4tn (-2.6% yoy) backed by a 23bps increased in NIM to 5.8% from prior month’s figure, a 12.6% mom growth in opex brought up CIR to 35.7% (Jun-23: 31.7%) and much lower annualized CoC of 55bps (Jun-23: 82bps).

- We maintain our FY23F earnings expectation of IDR48.8tn (+18.4% yoy) with 10.5% yoy loans growth, a 12bps uptick in NIM to 5.3% and 130bps CoC. Our sensitivity analysis suggests for every 10bps increase in CoC will lower net profit by 2.0% from our base case scenario.

- BMRI remains our top pick in the sector with an unchanged GGM-derived TP of IDR7,500 (implied 2.5x 24F PBV multiple) and 21.5% ROAE projection for next year. (Eka Savitri – BRIDS)

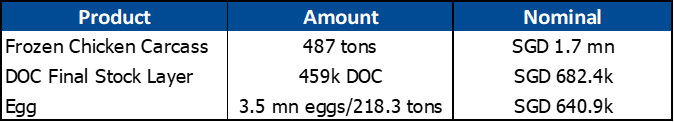

CPIN Exports Eggs to Singapore

CPIN, through its subsidiary, Gizindo Sejahtera Jaya, exports table eggs to Singapore. The most recent egg export is the 16th shipment of 557,280 eggs worth SGD101,730. CPIN conducted trial shipments since May 2023 and to date has carried out shipments of 3,492,720 eggs, equivalent to 218.3 tons worth SGD 640,940. On the 30th of June 2022, the Singapore Food Agency (SFA) approved Indonesian poultry products to enter Singapore. Several exports to Singapore have been conducted, as summarized in the table below. (Emiten News)

GIAA: Garuda looks more confident and with more vision

Merger talks with Pelita Air? No merger mandate has been conveyed to Garuda management level. specifics are not available (merger, partnership, code sharing synergies?). The rationale is centered on improving the medium/quasi service segment whereby combined with Batik air can address the air traffic demand better as per the new IR officer. Talks appear ongoing - on Aug 17th biofuel+avtur mix from Pertamina was tested on Garuda aircrafts for sustainable fuel use. Batik air and Pelita air fleets appear equal in size.

Garuda fleet strategy is very dynamic. To improve capacity GIAA aims for 6 more planes to restore into their current 101 plane fleet by YE-23. (GIAA is held back due to limited spare parts and global supply chain crunch. GMFI runs long backlog too for maintenance-restorations).

Garuda aims to ride the upcoming higher demand 2H23 but in a disciplined manner: Put more focus on flight safety standards, on-time performance - claimed to be all-time high and code-sharing.

The Garuda and SQ joint venture is milestone leveraging each other capacity in Singapore – Jakarta route. Partnerships still being seek with M. East operators and potentially with Turkish airlines in the works.

Structural gap in local aviation, the norm is for fares to go up more Only 50% of the population is served by ~500 planes currently available in Indonesia. Given this shortage, flight fares can increase. These are regulated, and Garuda is liaising with government to increase the fares upper price limit. Garuda cooperates with local airlines to optimize routes and their captive markets to improve productivity.

In short-term, pricing upside. ST pricing price upside and thus more profit margin can be sourced mainly from unscheduled flights (16.3% revenue contribution) and foreign destinations (un-regulated) incl. those for Hajj & Umroh to depart now from Surabaya, Medan, Makassar.

Ultimate priority is to improve the B/S negative equity Rp1.6tn. The IR officer suggests a combination of options need to work together to materially improve equity. These could be rights issue, debt reprofiling compatible with Islamic finance and improving profit, but nothing yet to report. In terms of P&L, profitability margins and net profit is said to be sustainable, only plane fuel and forex costs are arbitrary factors.

Our impression: GIAA appears more confident compared to the beginning 2023. The business and P&L appear robust only constrained by limited restoration planes. In response, Garuda management is racing to build channels with peers in the local market, Singapore, middle east and more. Any collaboration with Pelita air is a plus at this point optimizing fleet capacity and market landscape. (Niko – BRIDS)

PTBA’s Implements Good Mining Practice

PTBA implements Good Mining Practice with decarbonizing programs. One of the steps taken by PTBA is Eco Mechanized Mining, which is replacing mining equipment that uses fossil fuels with ones that use electricity. Currently, PTBA operates 7 units of Electric Shovels (PC3000-6E), 40 units of Hybrid Dump Trucks (Belaz-75135), and 6 electric-based Mine Pumps. The use of electricity-based mining equipment results in up to 7 ML reduction of fuel (BBM). Moreover, it reduces emissions by 19.777 tCO2e. Furthermore, there are 15 units of electric buses operated by PTBA. The use of electric buses reduces the use of fuel (BBM) oil by up to 9,672 litres/year/bus. (Emiten News)