|

FROM EQUITY RESEARCH DESK |

||||||||||||

|

IDEA OF THE DAY Astra International:1Q24 preview: possible decent headline figures, as strong expected UNTR earnings to offset weak auto (ASII.IJ Rp 5,025 HOLD; TP Rp 5,600)

To see the full version of this report, please click here Timah: Expect a major turnaround in FY24F from improving tin mining practices (TINS.IJ Rp 985 BUY; TP Rp 1,400)

To see the full version of this report, please click here To see the full version of this snapshot, please click here

RESEARCH COMMENTARY ACES Key takeaways from the BRIDS’ event with GAPMMI – 24 April 2024:

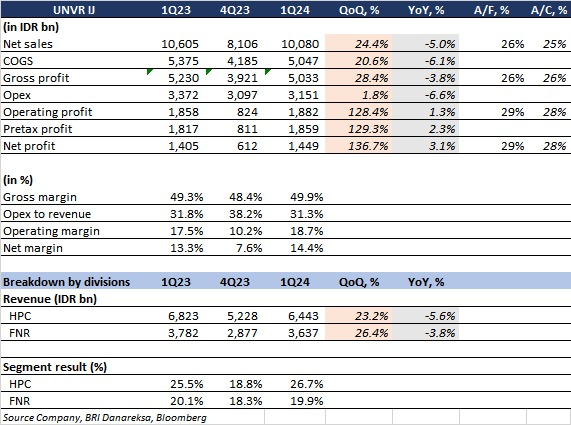

UNVR 1Q24 result: Broadly inline but still challenging outlook in 2Q24 onwards 1Q24 top line down 5% yoy with lower prices

1Q24 NP up 3.1%yoy due to the higher gross margin and royalty savings

MACROECONOMY Bank Indonesia Raises Interest Rates to 6.25% Bank Indonesia (BI) has decided to increase the BI Rate by 25 basis points to 6.25%, citing pressure on the IDR and rising global uncertainties. Such a move deviates from our base case /the consensus of no rate change, although calls for rate hikes were already increasing, especially with the absence of monetary contraction in recent weeks. The aim is to proactively address potential risks, such as delayed or no rate cuts by the Fed in 2024 and heightened tensions in the Middle East. (Bank Indonesia)

Comment: In our assessment, BI's window to lower the BI Rate in 2024 is narrowing, given their baseline scenario indicating only one rate cut by the Fed in December 2024. Faster rate cuts are unlikely, as they could undermine IDR stabilization due to lower yields and rate spreads. (Economic Research – BRIDS)

SECTOR Consumer: The Government Adjusts the Government Purchasing Price of Grain/Rice and Corn The government immediately adjusted the government purchasing price (HPP) of grain/rice as well as the highest retail price (HET) of rice. This increase includes, among other things, HPP for harvested dry grain (GKP) for farmers to Rp6,000/kg (in accordance with the flexibility figures in effect from 3 April-30 June 2024), HET for medium rice to Rp12,500/kg, and HET for premium rice to Rp14. 900/kg (according to the relaxation amount which has been extended until 31 May 2024). Meanwhile, the reference price for corn for dry shelling with a moisture content of 15% is likely to be increased to Rp5,000/kg (Previously: Rp4,200). Currently, legal protection in the form of National Food Agency regulations is being prepared. (Investor Daily)

CORPORATE PTPP Acquired Rp4.9tr of New Contracts in 1Q24 PTPP secured new contracts worth Rp4.9tr in 1Q24, bringing its total contracts in the National Capital City to Rp11.23tr. The company is working on two contract packages, Central Government Core Area 1 and KIPP 2, with infrastructure completion expected by August 17, 2024. Other construction projects include the VVIP Airport, Toll 3B, West Kebangsaan Axis, and Toll 6C. PTPP is also working on several projects, including the Presidential Palace, the President's Office, ASN-Hankam flats, the Bank Indonesia office complex, and the PUPR Ministry Building. (Kontan)

TBIG Prepares Rp800bn for the Buyback of 396.50mn Shares TBIG plans to buy back 396.50mn shares with a nominal value of Rp800.80bn, reaching 1.75% of the total shares. The company has prepared a maximum fund of Rp800,800,000,000 sourced from internal cash. After shareholder approval, the buyback process will begin in stages from 31 May 2024 to 30 May 2025. (Bisnis) |

||||||||||||

BRI Danareksa Sekuritas Equity Snapshot - April 25, 2024

Equity Research

25 Apr 2024