|

FROM EQUITY RESEARCH DESK |

|||||||||||||

|

IDEA OF THE DAY |

|||||||||||||

|

RESEARCH COMMENTARY ACES TLKM: Telkom 1Q24 earnings call takeaways: Telkomsel defends market share in a profitable way, and hence in a constructive and credible manner for themselves and the sector, in line with our thesis.

Our comment on share price reaction post earnings call; ISAT/EXCL go up while TLKM falls. We believe that the ISAT/EXCL gains at the expense of TSEL dominates. We see instead a quite adaptive strategy for TSEL as it adjusts its portfolio to resonate better with the subs base with a stable ARPU yoy in 1Q24. This strategy already delivers with a higher data traffic growth trajectory. (Niko Margaronis – BRIDS)

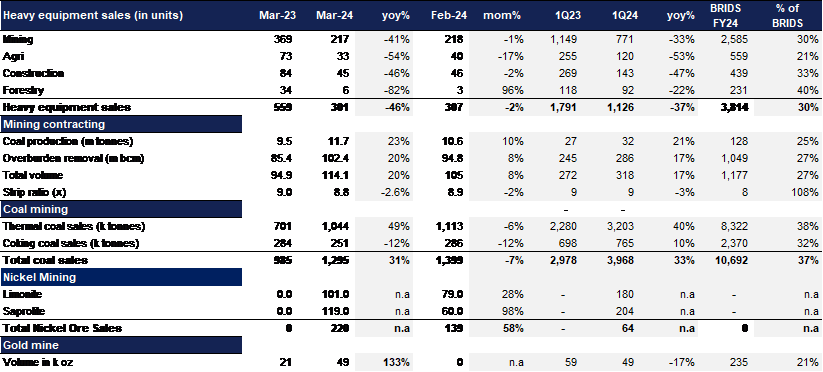

UNTR: Strong Mar24/1Q24 operational achievement

HMSP’s 1Q24 cigarette sales volume +1.6% yoy

Industry & INTP Cement Data Mar-24

SMGR Mar24 Volume

MACROECONOMY Preliminary April PMI Numbers in Advanced Economies (AE) Preliminary April PMI numbers in Advanced Economies (AE) indicate a notable expansion in the service sectors, while the manufacturing sector continues to contract.

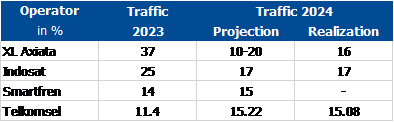

SECTOR Telco: Data Traffic during Eid Holidays Increased by 17% Data/internet service traffic on four telecommunications operators in Indonesia increased by 17% during the Eid holiday in 2024. This realization is lower than estimates of up to 20%. The increase in traffic was mainly triggered by homecoming activities that require data and application services. (Investor Daily)

The following is the data traffic during the Eid holiday in 2023 and 2024:

CORPORATE BBCA’s QRIS Transaction Volume Increased by 153% in 1Q24 BBCA recorded a 153% yoy increase in QRIS transaction volume in 1Q24. Meanwhile, the transaction value reached Rp41.6tr (+156% yoy). The company's strategies to pursue this growth include expanding the QRIS cross-border feature to meet customer transaction needs abroad. BBCA has also adjusted the daily QRIS transaction limit for combined payments of up to Rp25,000,000, which previously followed the daily debit card limit. (Kontan)

BMRI and Wise Collaboration Saved IDR 35 Billion in Foreign Exchange Transfer Fees BMRI and Wise have collaborated for over a year to help customers transfer money between countries at affordable costs, which has resulted in Livin' by Madiri customers saving up to Rp35bn on inter-country foreign exchange transaction costs. For information, Wise is a global technology company that operates in the international payments sector and aims to provide money without borders. (Investor Daily)

DOID to Carry Out a Buyback of 819.87mn Shares DOID will carry out a share buyback of 819.87mn shares or 10% of the company’s issued and fully paid-up capital as it received shareholders' approval during the EGMS. (Kontan)

HMSP to Distribute Dividends of Rp8.06tr HMSP plans to distribute dividends of Rp8.06tr, equivalent to Rp69.3/share (yield: 8.2%). The dividend amounts to 99.56% of HMSP’s 2023 net profit of Rp8.09tr. (IDX Channel)

MAPA’s Commissioner Reduced Her Share Ownership Portion MAPA’s Deputy Main Commissioner reduced her share ownership from 27,720,000 to 27,120,000 shares, or 0.097% to 0.095%, between March 20-21, 2024, selling 600,000 shares at a price of Rp1,045-1,060 per share. (Emiten News)

To see the full version of this snapshot, please click here |

|

||||||||||||

BRI Danareksa Sekuritas Equity Snapshot - April 24, 2024

Equity Research

24 Apr 2024