|

FROM EQUITY RESEARCH |

|

||

|

Healthcare: On track 4Q23 operational affirm attractive growth and return outlook (OVERWEIGHT)

To see the full version of this report, please click here

To see the full version of this snapshot, please click here

MARKET NEWS |

|

||

MACROECONOMY

China CPI Rose by 0.7% yoy in Feb24

China CPI rose by 0.7% yoy in February 2024, above market forecasts of 0.3% and a turnaround from the sharpest drop in over 14 years of 0.8% in January. The latest result was the first consumer inflation since last August, hitting its highest level in 11 months due to robust spending during the Lunar New Year holiday. Food prices declined the least in eight months (-0.9% vs -5.9% in January). The core CPI increased by 1.2% yoy in February, the most since January 2022. (Trading Economics)

Indonesia FX Reserve Decline to US$144bn in Feb24

FX Reserve declined to US$144bn in Feb24 (vs. Jan’s US$145.1bn) due to the payment of Government’s foreign debt. (Bank Indonesia)

US CPI Rose by 3.2% yoy in Feb24

US CPI unexpectedly edged up to 3.2% in February 2024, compared to 3.1% in January and above forecasts of 3.1%. Energy costs dropped much less than expected (-1.9% vs -4.6% in January), with gasoline declining 3.9% (vs -6.4%). Meanwhile, the monthly inflation rate rose to 0.4% from 0.3%, with prices for shelter and gasoline contributing over 60% of the increase. On the other hand, core inflation eased to 3.8% from 3.9%, compared to forecasts of 3.7%. The monthly rate remained steady at 0.4%, instead of forecasts of 0.3%. (Trading Economics)

SECTOR

Automotive: National Car Sales Declined in Feb24

Four-wheel vehicle sales experienced a decline in performance in the first 2 months of 2024. Based on Gaikindo data, national car wholesales sales corrected by 22.6% yoy to 140,274 units. National car retail sales decreased by 15% yoy to 148,649 units. On a monthly basis, national car wholesales rose 1.5% qoq to 70,657. However, national car retail sales declined 10.3% qoq to 70,291 units. Toyota still tops the national car market share with wholesales sales of 44,513 units, followed by Daihatsu brand posting wholesales sales of 29,451 units. After that, Honda scored wholesales sales of 17,494 units, Mitsubishi Motors achieved wholesales sales of 12,956 units, and Suzuki recorded wholesales sales of 11,131 units. (Kontan)

CORPORATE

BRIS Mobile Transactions Reached Rp47tr as of January 2024

BRIS Mobile Transactions reached 38mn with a volume of up to Rp47tr as of Jan24. Meanwhile, transactions using BRIS QRIS stood at 5mn transactions with a volume of Rp697bn. (Investor Daily)

KLBF Breakthrough with Small Cell Lung Cancer Drug

KLBF released a first-line drug for extensive stage small cell lung cancer (ES-SCLC) called Serplulimab. The launch of Serplulimab, which is the result of a collaboration with Shanghai Henlius Biotech Inc, was conducted last Saturday. It is a further step after KLBF obtained a distribution licence in Indonesia from BPOM RI on Dec23. KLBF will also try to market this product abroad. The countries targeted include countries in Southeast Asia, the Middle East and North Africa. (Kontan)

PTBA: Rp2.9tr Capex Budget in 2024 and Partnership with Chinese Company

PTBA has budgeted Rp2.9tr Capex in 2024. This capex will be used for several things, such as unlocking logistics, meaning that PTBA's mined reserves can be sold by increasing capacity. This year, PTBA targets coal production of 41.3Mt, sales of 43.1Mt, and transportation of 33.7Mt (CNBC)

In other news, PTBA is exploring a partnership with Chinese company East China Engineering Science and Technology Co. Ltd. to work on the government's downstream programs, such as coal gasification into dimethyl ether (DME) and review of other derivative products such as methanol and ethanol. (Investor Daily)

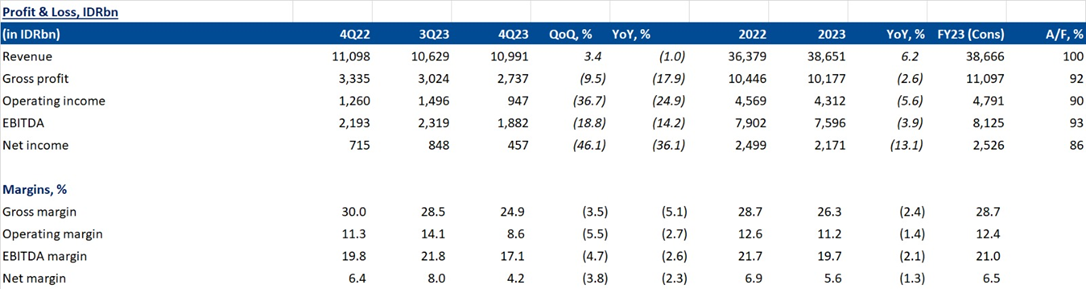

SMGR IJ: FY23 Results

- NP reached Rp 2.2t in FY23 (-13% YoY), 86% of consensus - miss, due to higher salary booked in 4Q23. 4Q NP reached Rp 457b (-46% QoQ/-36% YoY). Higher opex in 4Q23 also lead to 470 bps QoQ lower EBITDA margin.

- Revenue reached Rp 38.6t in FY23 (+6% YoY), 100% of consensus - inline. Volume increased by 10% YoY, with ASP at Rp 861k/ton (-4% YoY). 4Q23 revenue and ASP were quite stable on QoQ basis.

- GPM reached 26.3% in FY23 (-240 bps YoY) due to full impact of price increase on subsidized fuel since 4Q22 despite relatively stable ASP along 2023. (Richard Jerry, CFA – BRIDS)